What Is an “Instant Offer”?

An “Instant Offer” is an offer (with stipulations) on a consumer’s vehicle or home that is given before examining the asset. The offer amounts are estimations, based largely on the initial description, and partly to size, location, etc. These offers are only considered “instant” because they are given before inspection of the asset – it doesn’t even necessarily mean that the end of the process always leads to an immediate offer, as it can take up to two days to get a response from some of these sites and/or their affiliates2. Once the “Instant Offer” is accepted, an investor/dealer must inspect the asset, and determine the validity of the estimate before buying it. An increasing number of companies are trying to make “instant offers” on consumers’ valuable assets, and it’s gaining popularity – as well as skepticism. For some, it seems outright unreasonable to make an offer on something before being able to know if it needed repairs. To use this practice, businesses had to figure out a method of employment that would minimize the risk associated with it.

How Do Instant Offers Work?

Whether it’s a car or a house, there’s usually a general value associated with it based on size, maker, location, condition, and other crucial factors. It can seem reasonable to say one house is a certain size in a certain location, and other houses with comparable size in the same location have a similar value, therefore this house must be worth the same value as the other houses. If the house is in perfect condition, that is very likely to be a good appraisal. However, every home is in a different condition than the ones around it. Any real estate investor or car mechanic can tell you that repair costs can run away very quickly. It’s difficult to value a car without being able to first factor in whether the engine light being on means the car needs a $100 repair, or a $5,000 repair. Likewise, it’s difficult to value a house without being able to look at the roof or foundation first to determine if they need tens of thousands in repairs. Factors such as that can change the value of an asset dramatically, and they must be considered by the buyer to minimize risk. On the other hand, if the roof and foundation are perfectly fine, it wouldn’t be reasonable to deduct $30,000 from the offer and allocate those dollars to repairing something that doesn’t need to be repaired. If the repairs are grossly overestimated, the offer will be viewed as too low, or even insulting. That can deter many customers from a service very quickly. How can this be avoided, while still allowing companies to make “instant” offers? It’s simple.

“Instant Offers” Are Usually Markedly High to Attract Interest, But They Plan To Deduct From It Later

Unfortunately, that’s how it works with some of these “instant” offers. Somewhere along the process, in the fine print, it may mention something to the effect of, “If the inspection report differs from your description or online assessment of your vehicle’s condition, the Participating Dealer may adjust the offer amount, which may result in a decrease of the offer1,” or something like, “A home inspector will check your home’s condition to make sure there are no surprises that could impact your offer2.” Surprises are never good when it comes to selling our assets. Many people who choose one of these “instant offers” are surprised later when the first offer no longer stands anymore, and the new offer is much, much lower.

Who Gets Access to Personal Information?

Some of the people who offer to buy someone’s house/car aren’t always a part of the company who was contacted in the first place for the offer. With some of these services, there is 3 or 4 real estate investors / “Participating Dealers” who are sold your information. Other services have internal employees who do the purchasing, and personal information never leaves the company. There are some exceptions, of course, but for some, it can be found in the fine print that, “Participating Dealers are not owned or operated by, nor are they affiliated with or acting on behalf of, Kelley Blue Book. Participating Dealers pay Kelley Blue Book or its affiliate to subscribe to the Kelley Blue Book Instant Cash Offer program1,” or comparably, that “Zillow Group may give business partners access to Personal Information only as necessary to offer products and services with those business partners3.” In those cases, the company that the consumer contacted initially for the offer is not going to be involved in the buying your car/house at all. These “Instant Offer” websites frequently act as a simple lead generation source for the people who are willing to pay the highest amount to the well-known companies to funnel business towards their not-so-well-known company. Those familiar, well-known companies use the trust consumers have in them to sell their information to other people/companies, and subsequently step away from the transaction, except to facilitate the documentation of it4. Therefore, no risk is associated with the company, and they are still able to make money providing their “service” to consumers.

How Can Consumers Know What’s a Real Offer?

Does this mean we can’t trust a cash offer to be consistent when trying to quickly sell one of our assets? The answer may be simple, but it’s often taken for granted: Do some research. Consider where your information is going, and the process that is employed. Try to look at it from the perspective of the buyer. Would you spend $100,000 on something you are not able to see the condition of first, let alone $100? Of course not. There’s no way to determine the value of a large asset until it is inspected and all factors are considered. It’s very likely not going to be a reasonable offer unless the buyer has been able to fully inspect and account for the uniqueness of the situation. It isn’t reasonable to expect an offer to be reliable if the buyer having looked at the property first. These “instant offers” are just a way to entice a consumer during the initial interaction, often providing false hope, and getting around to the honest offer once the consumer has already invested enough of their time and energy to make it seem like a waste of time to try elsewhere. Selling a home traditionally, by listing it, will get the seller the most money for their home, if it is in a sellable condition. For those homeowners whose house may be in a state of disrepair, or vacancy, it can be a much less stressful process to sell their home quickly, as-is to a cash buyer who is able to close quickly. While these “instant” offers may be an interesting marketing technique, they aren’t reliable until you’ve had a buyer come look at the house. Unless they’re on-the-spot, examining the house at the time of the offer, the buyer doesn’t have a realistic, applicable basis for their offer, and it isn’t a real offer at all. Every home or car has a different situation and set of afflictions. It simply can’t be a trustworthy offer if it’s made from an entity that hasn’t taken any measures to assess the situation first.

What Are Our Options?

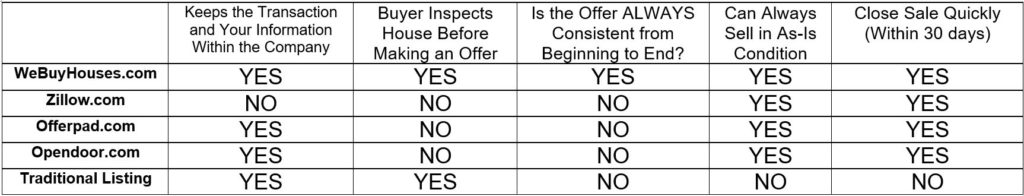

Let’s look at a few options when it comes to selling your house:

Click here to RETURN TO PAGE 1 of this article

We Buy Houses® and WeBuyHouse.com® are registered trademarks of WBH Marketing, Inc.