ABSTRACT:

ABOUT THE REPORT:

Every December, WeBuyHouses.com – the most recognized and trusted brand among cash home buyers – surveys its independent business owners and asks: what will next year be like in your market? This year, the company received responses from 45 of their local market affiliates, offering a unique insight into the professional “home flipping” business – and the real estate market, in general – at local, regional and national levels.

Specifically, we asked 5 questions:

1) HOME PRICES – going up, down or about the same as 2018?

2) INVENTORY OF EXISTING HOMES FOR SALE – going up, down or about the same?

3) CONTRACTOR COST (LABOR) – going up, down or about the same?

4) MATERIALS COST – going up, down or about the same?

5) In 2019, will it be a SELLER’S or BUYER’S MARKET (or EVEN) in your area?

KEY FINDINGS:

WeBuyHouses.com makes the following housing market predictions for next year:

-

-

Home prices are expected to level out in 2019. They will drop on the West coast, rise in the South, and start to level out everywhere else. On average, we expect home prices to rise about 3% next year (to a predicted year-end median price of $264,000).

-

-

-

Inventory of existing homes available for sale will rise in most markets in 2019. As a result, we’ll see days-on-market increase, resulting in a slower turnover rate for invested capital. Longer DOM will require more investment in marketing properties for sale.

-

-

-

The market switches from a Seller’s Market to a Buyer’s Market over 2019.

-

-

-

Home renovation costs will rise in 2019 in almost every market. Labor and materials will be in high demand next year, even as home prices start to soften. Rising renovation costs combined with softening prices will put margin pressure on real estate investors and push many unprofessional players out of the market.

- Rising interest rates are a big factor in slowing down the housing market. The Fed might have wanted to cool down a market that ran too far too fast. We don’t know, but we expect 5%+ home mortgage rates a year from now (up 75 basis points from here).

-

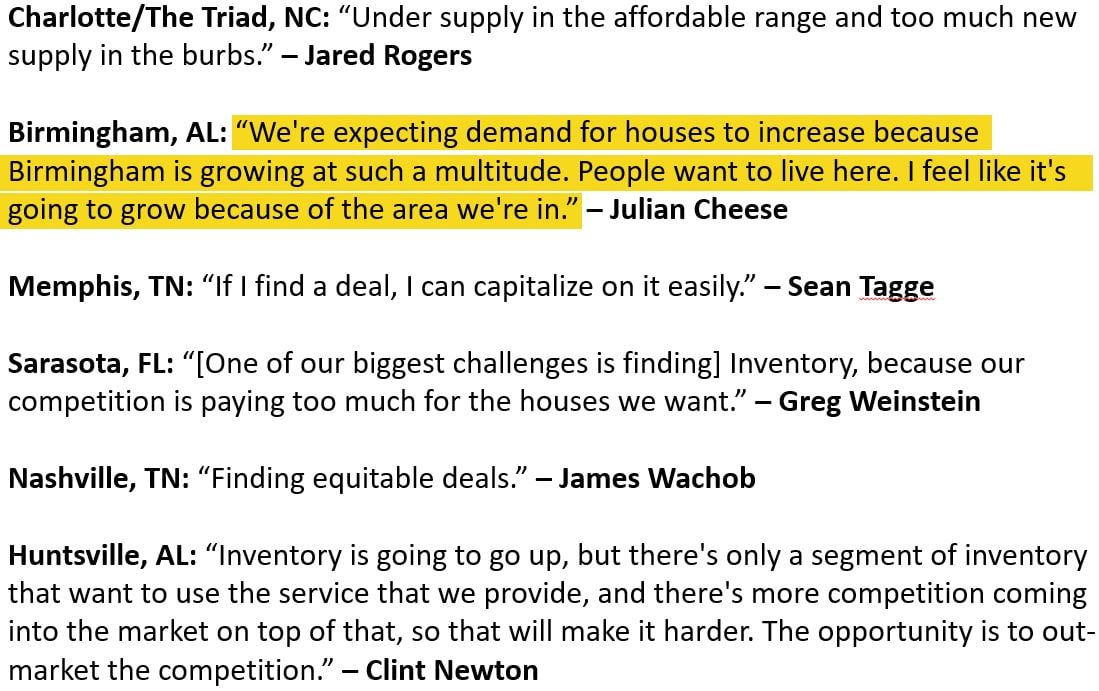

QUOTES:

CEO Jeremy Brandt summed up their outlook for 2019: “After five years of non-stop price increases in most areas, residential real estate is likely to slow down in most local markets next year. In 2018, we’ve definitely seen the cooling effects of rising interest rates (up 70 basis points since our last survey), and we expect that to continue with similar increases in 2019.”

Dev Horn, VP Marketing and author of the 2019 Report, added: “The pull-back will be most dramatic in West, particularly California. Luxury home prices hit the wall in 2018 and will continue to drop as demand softens next year, while entry-level housing is likely to rise in value a bit more as demand will remain strong for at least another year.”

REGIONAL SUMMARIES:

THE NORTHEAST

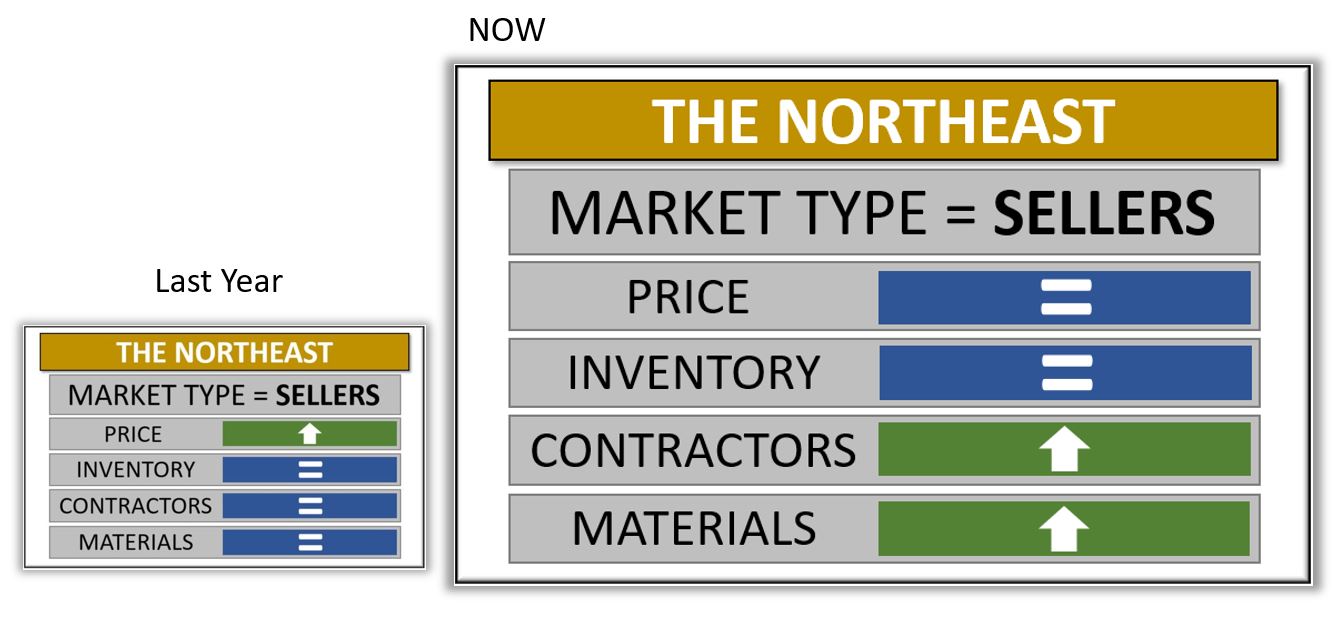

- In the Northeast, the big change compared to last year, is that the respondents now say prices will shift from going up to starting to level out.

They once again believe inventory will be the same as last year, but they also see that the price of contractors and materials will be increasing in cost in the Northeast compared to last year.

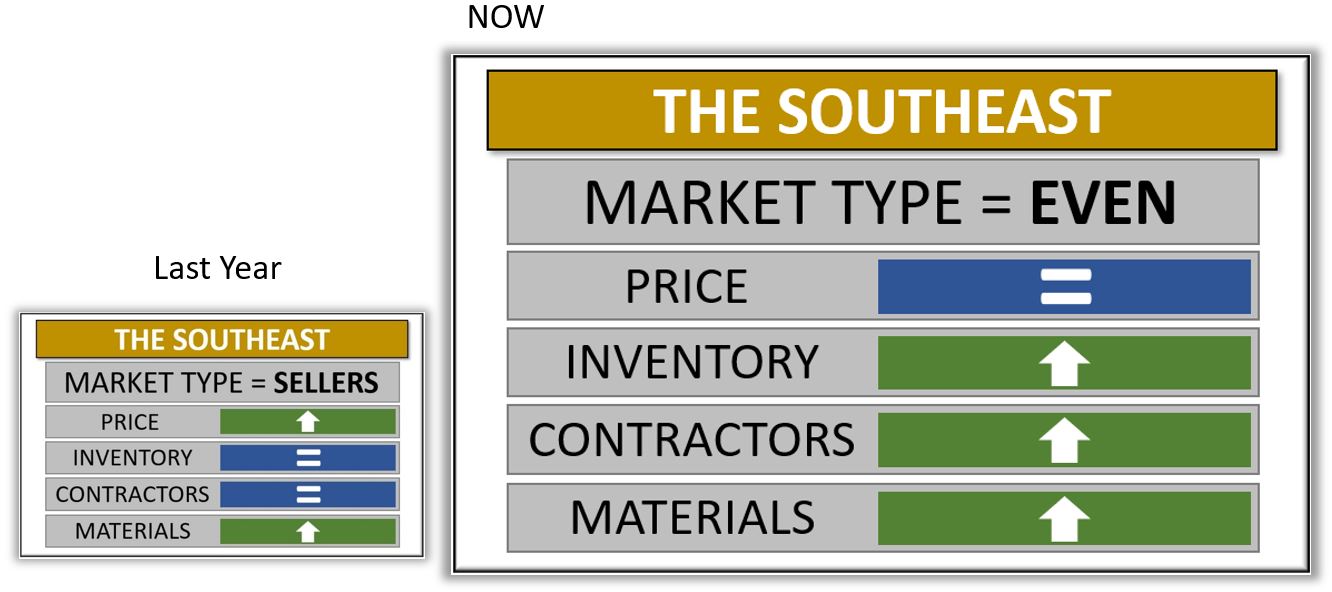

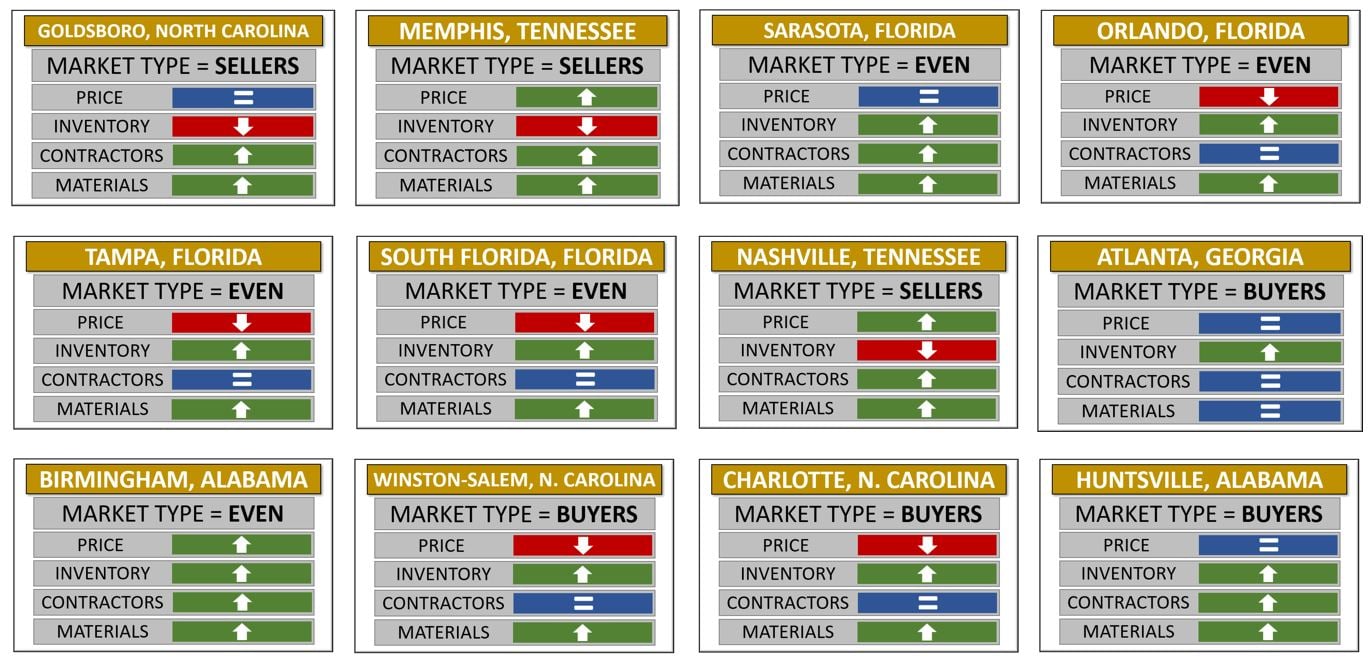

THE SOUTHEAST

- In the Southeast, here again, we see that the prices of homes will be leveling out (compared to rising last year).

We also see that inventory is increasing. This shows again a cooling market – not a cool market, but one that’s not as hot as last year and has started to level out. We see contractors and material costs increasing in the Southeast.

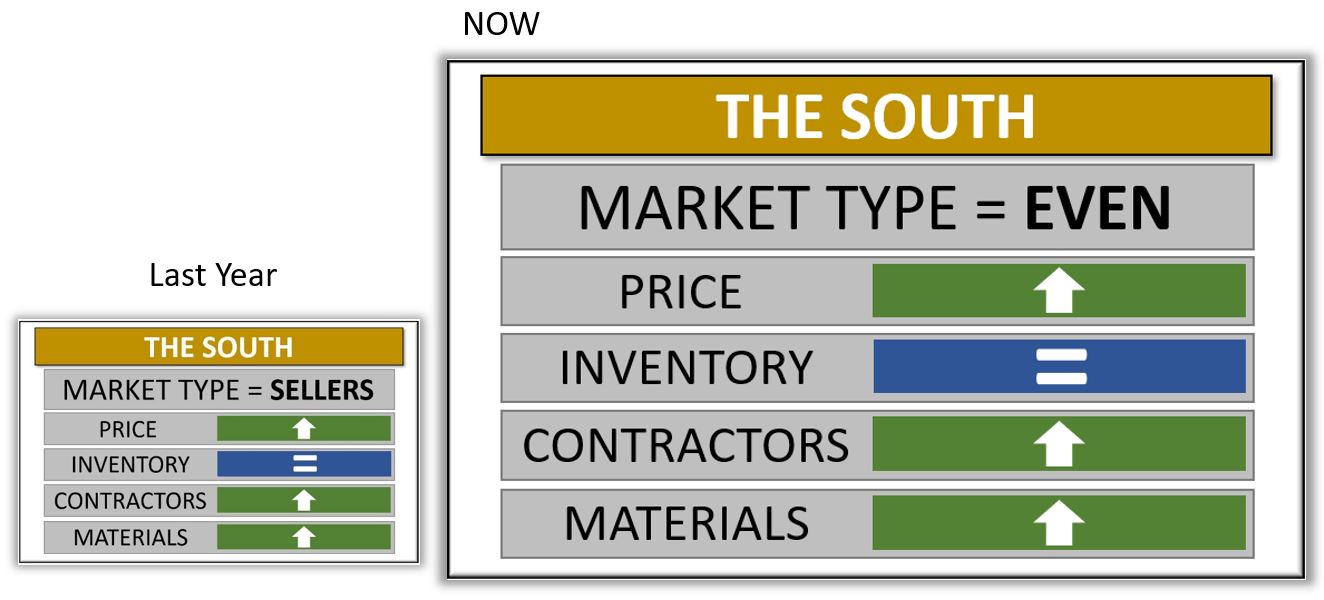

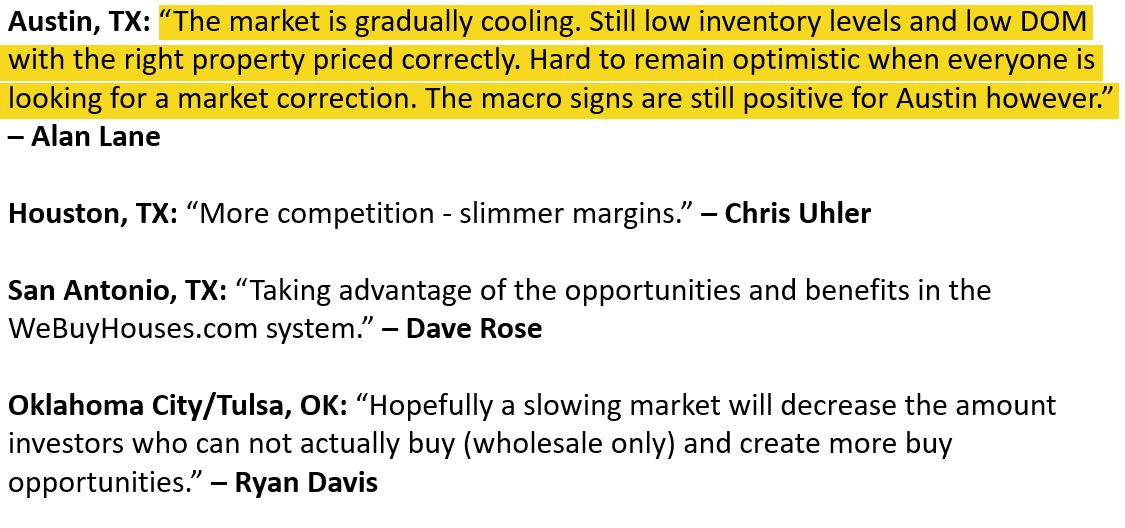

THE SOUTH

In the South, we see the same this we saw last year. The south is the only region of our four this year that indicated prices will continue to rise.

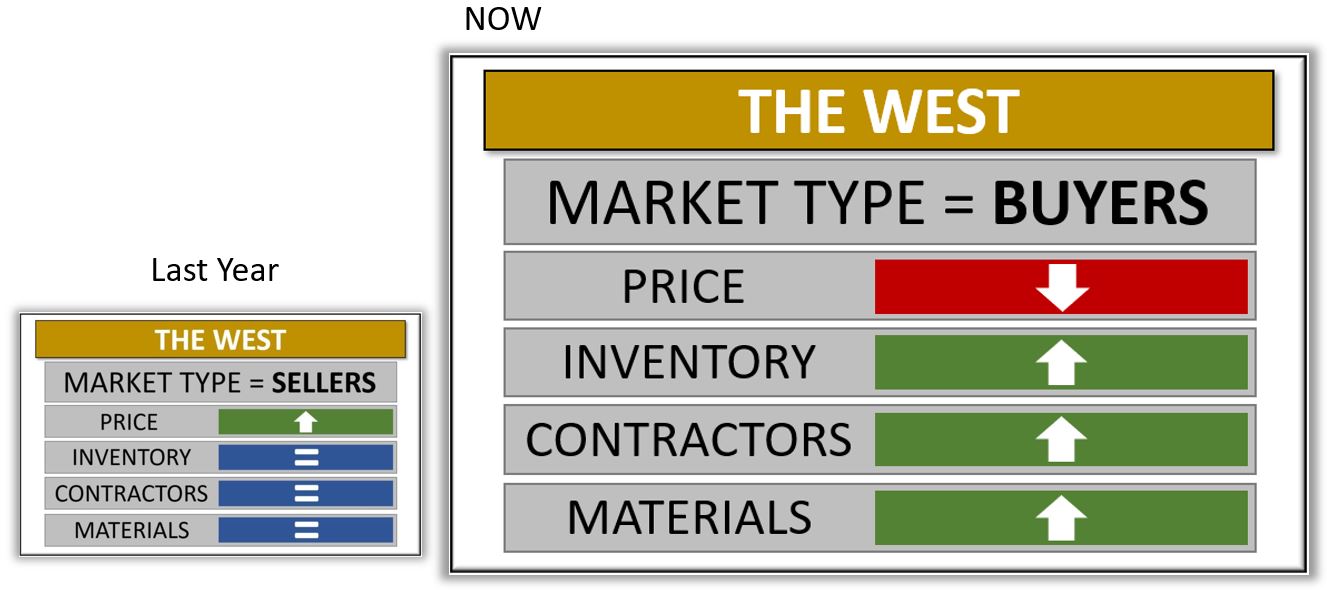

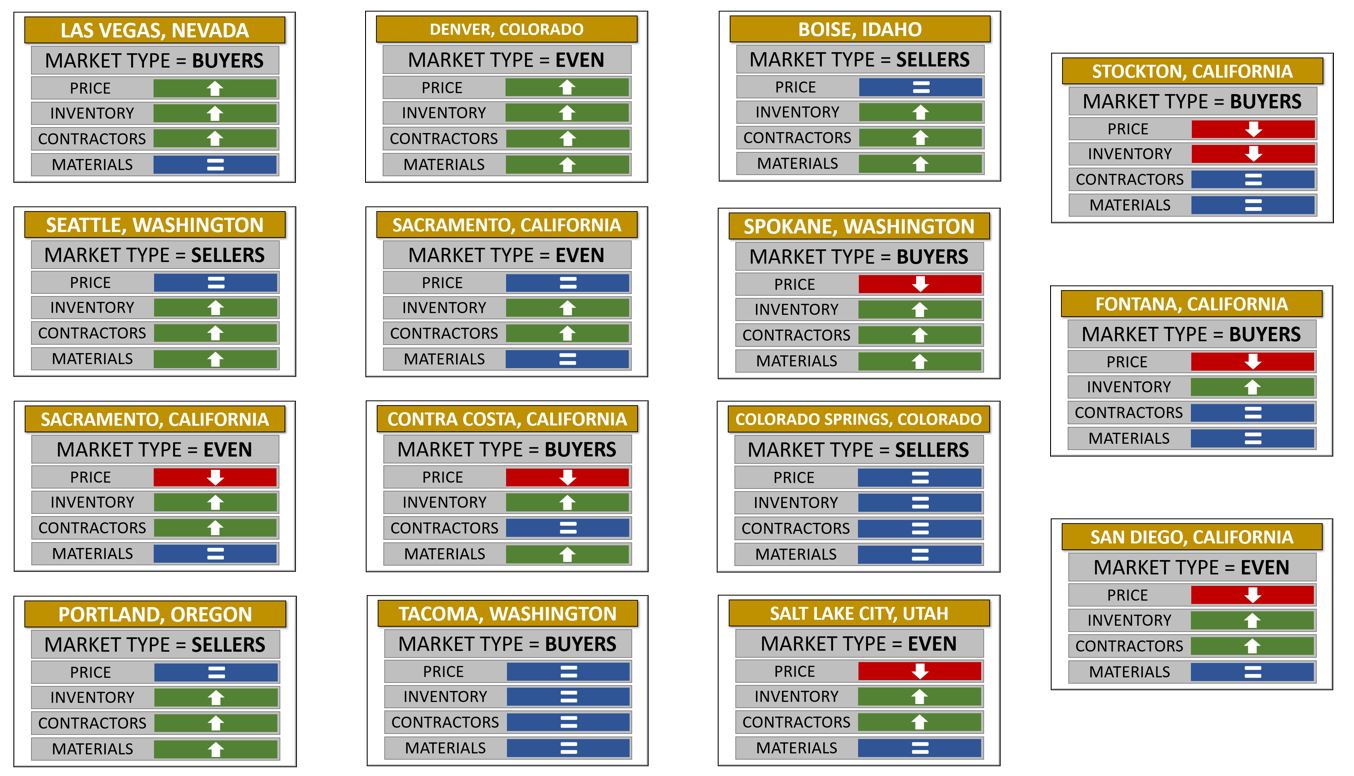

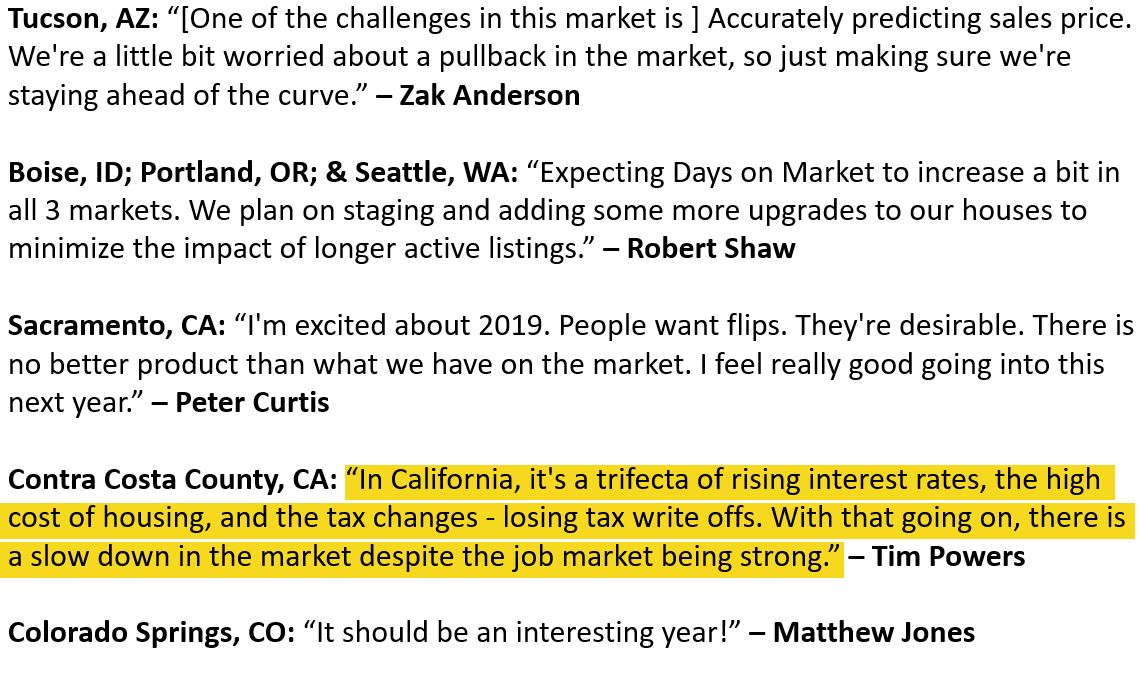

THE WEST

- In the West, we see the most dramatic change in prices and inventory levels.

Earlier this year, markets such as the ones in California, Idaho, and Oregon started to his their tipping point where they began to turn downward. Last year, respondents expected prices to increase and inventory to stay tight. This year, however, they believe prices will drop and inventory will rise in the coming year. There we see that classic cooling off of the market, as indicated by prices and inventory. As with all of the other markets, we see the cost of materials and labor increasing in the West in 2019.

PRESS: Materials available include local market infographics and local expert commentary for all 45 markets and the 4 regions. Our CEO and local market experts are available for interviews, and high-resolution headshots are available as well.

FOR MORE INFORMATION: Contact WeBuyHouses.com at [email protected].

![]()

THE WEBUYHOUSES.COM 2019 HOUSING MARKET REPORT (EXPANDED)

We asked these 5 questions of 46 local market experts in 45 local markets across the U.S.:

- Do you expect home prices to…?

- Rise

- Fall

- Or be about the same as in 2017

- Are you expecting the available inventory of investment properties to…?

- Increase

- Decrease

- Or be about the same as 2017

- Do you expect the cost of labor & contractors in your market to…?

- Rise due to high demand

- Fall due to less demand

- Or stay about the same as in 2017

- Do you expect material costs to…?

- Rise due to high demand

- Fall due to less demand

- Or stay about the same as 2017

- What type of market will it be in your area next year?

- a seller’s market

- a buyer’s market

- or about even

In this report we’ll look at our experts answers to these five questions on three levels: national, regional, and local. Let’s start at the national overview level, and review what the WeBuyHouses.com local market experts in 45 markets told us.

National > Overview

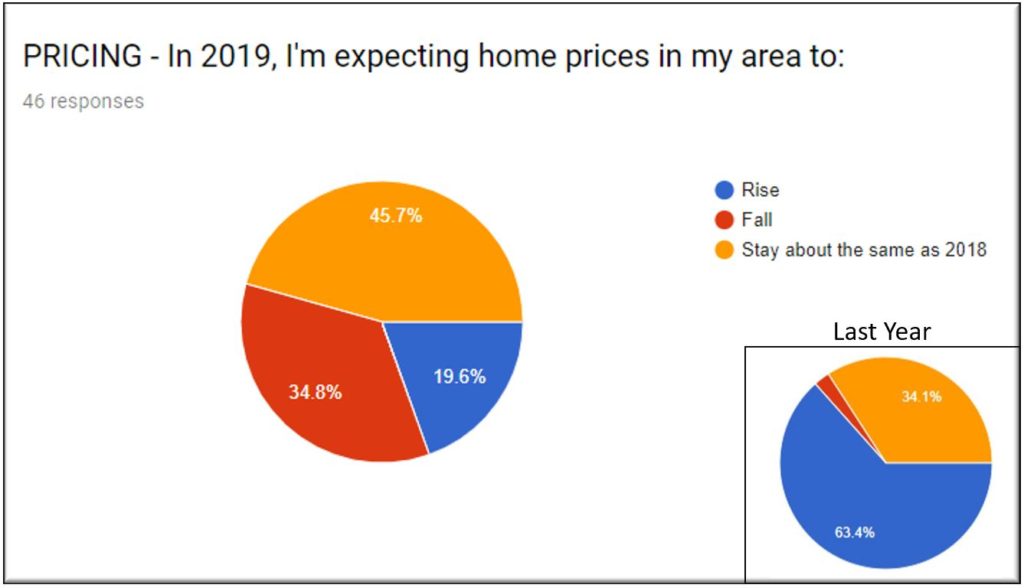

Home Prices

Regarding pricing on a national level, WeBuyHouses.com business owners across the United States expect prices to rise in only 19.6% of their markets, which is a dramatic decrease from their projections last year. They expect home prices to stay about the same as in 2018 in 45.7% of their markets, and fall in 34.8% of their markets.

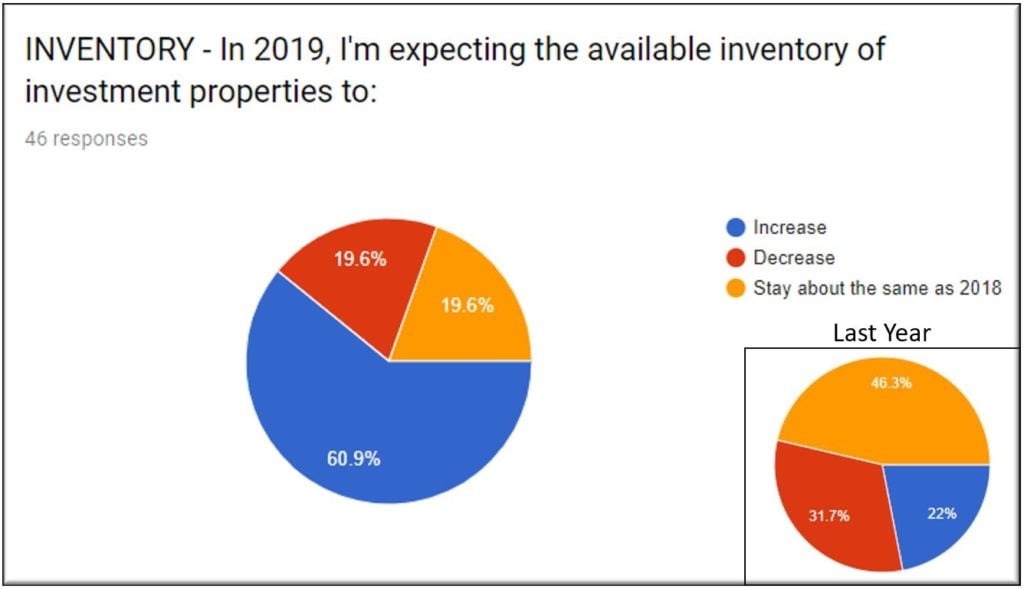

Inventory

Regarding inventory in 2019, the WeBuyHouses.com local market experts are expecting inventory to increase in 60.9% of markets, almost 3 times more than last year. They expect inventory levels to decrease in 19.6% of markets and be about the same as 2018 in 19.6% of markets.

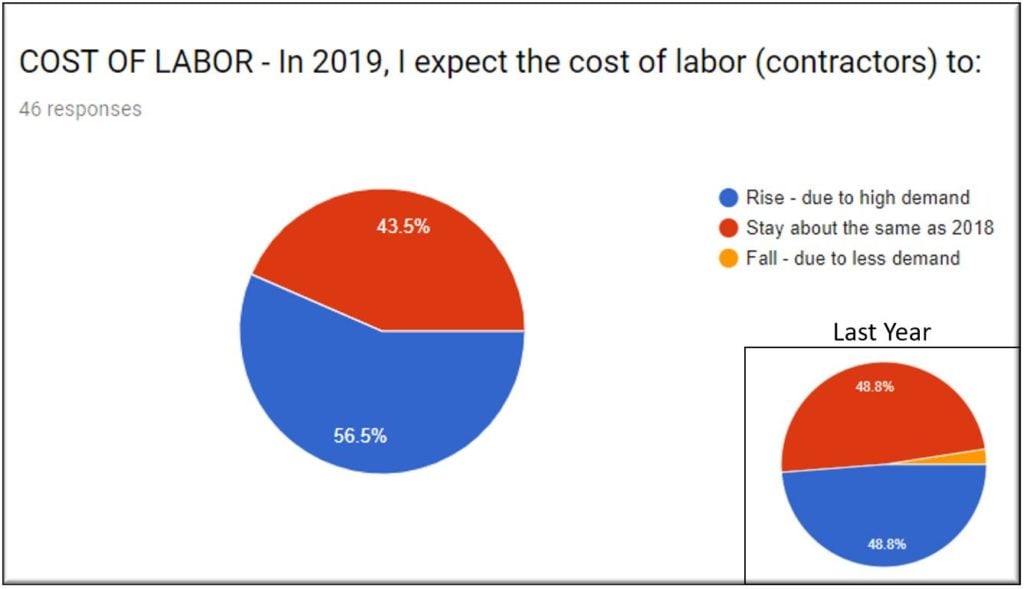

Cost of Labor

Regarding the cost of labor, the local market experts at WeBuyHouses.com say that they expect labor costs to rise in 56.5% of the markets – almost 8% more markets than last year. They also project labor costs to stay about the same in 43.5%. There were no respondents that expected the cost of labor to fall. We are expecting the availability of contractors to be tight again for 2019, just as it was in 2018, and therefore we’re expecting rising costs in many of our markets.

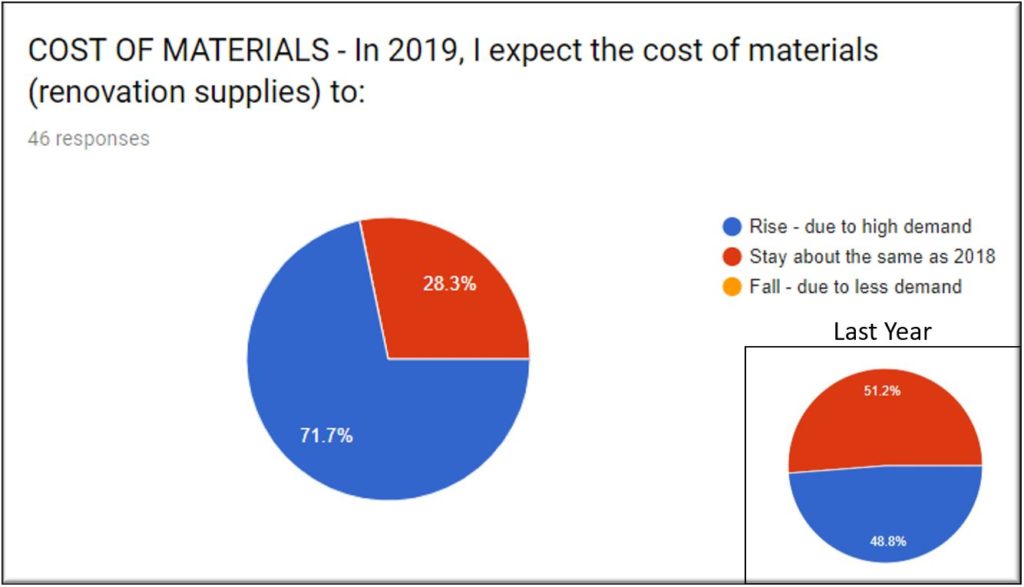

Cost of Materials

Regarding the cost of materials in 2019, our local market experts continue to see material costs rise and 71.7% of the markets, almost 23% more than last year. The respondents projected that the cost of materials will stay about the same in 28.3% of markets. Overall, we believe that the cost of materials will be increasing in 2019 for most of our professional real estate investors.

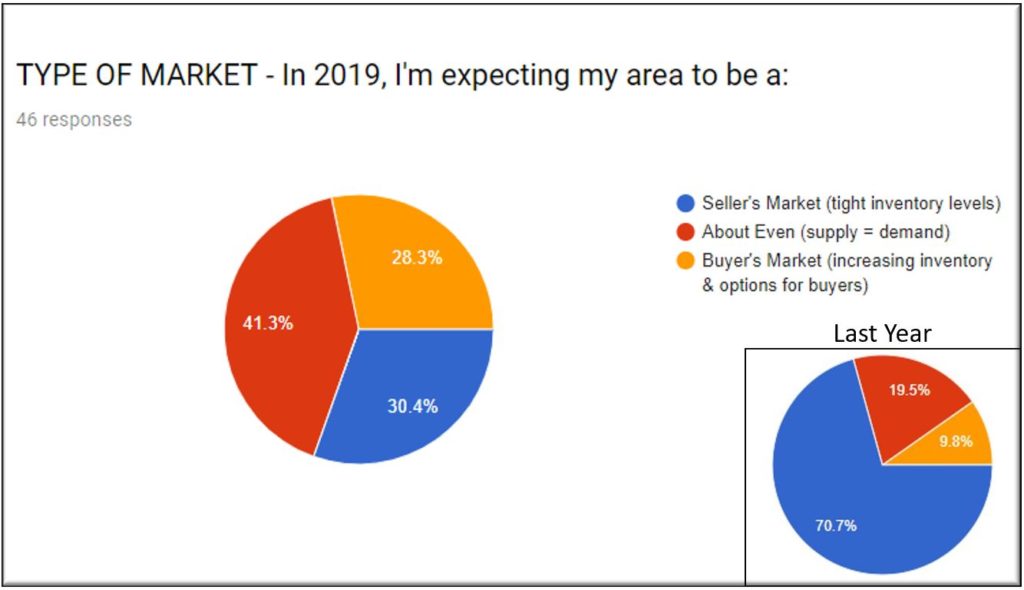

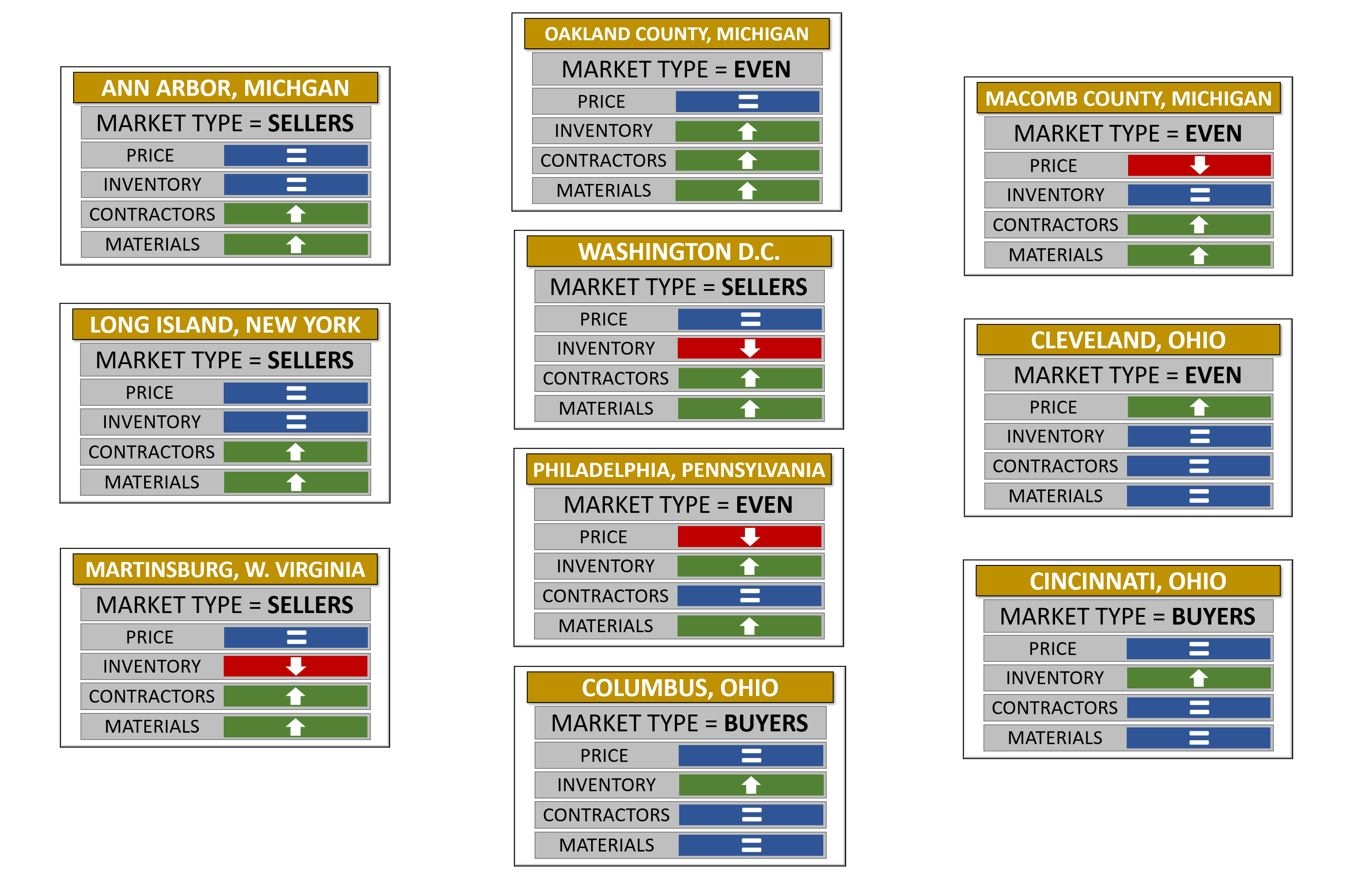

Type of Market

WeBuyHouses.com business owners around the country said that next year in 41.3% of their markets, it will be an even market, compared to 19.5% last year. Respondents in 28.3% of our markets project their area to be a buyer’s market, compared to only 9.8% last year. There’s only 30.4% of respondents who believe their market will be a seller’s market in 2019, compared to 70.7% last year. It is clear that markets all around the country are in the process of cooling off and shifting towards buyer’s markets. Let’s take a look at which markets around the country make up those percentages.

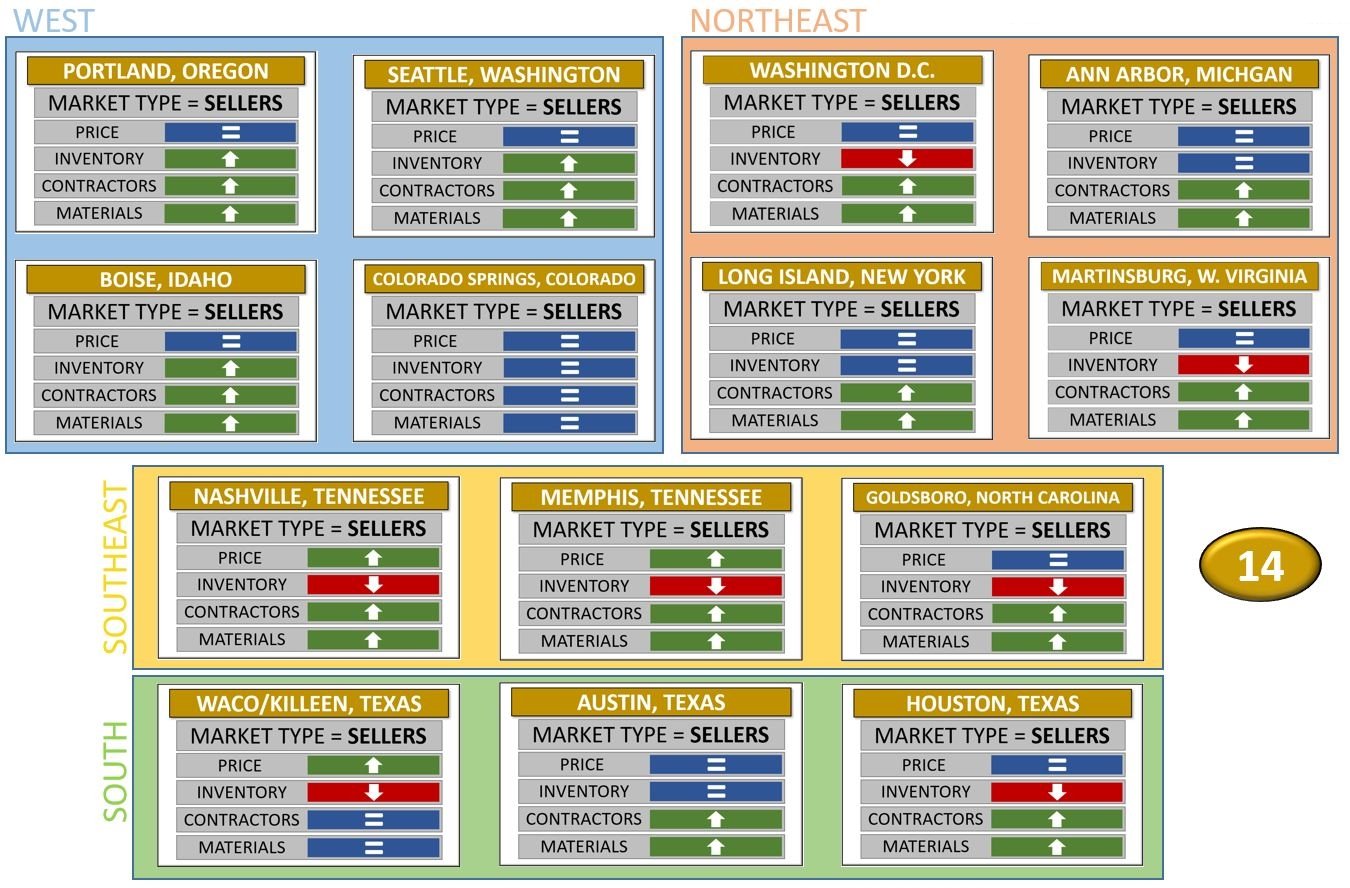

Seller’s Markets Around the Country

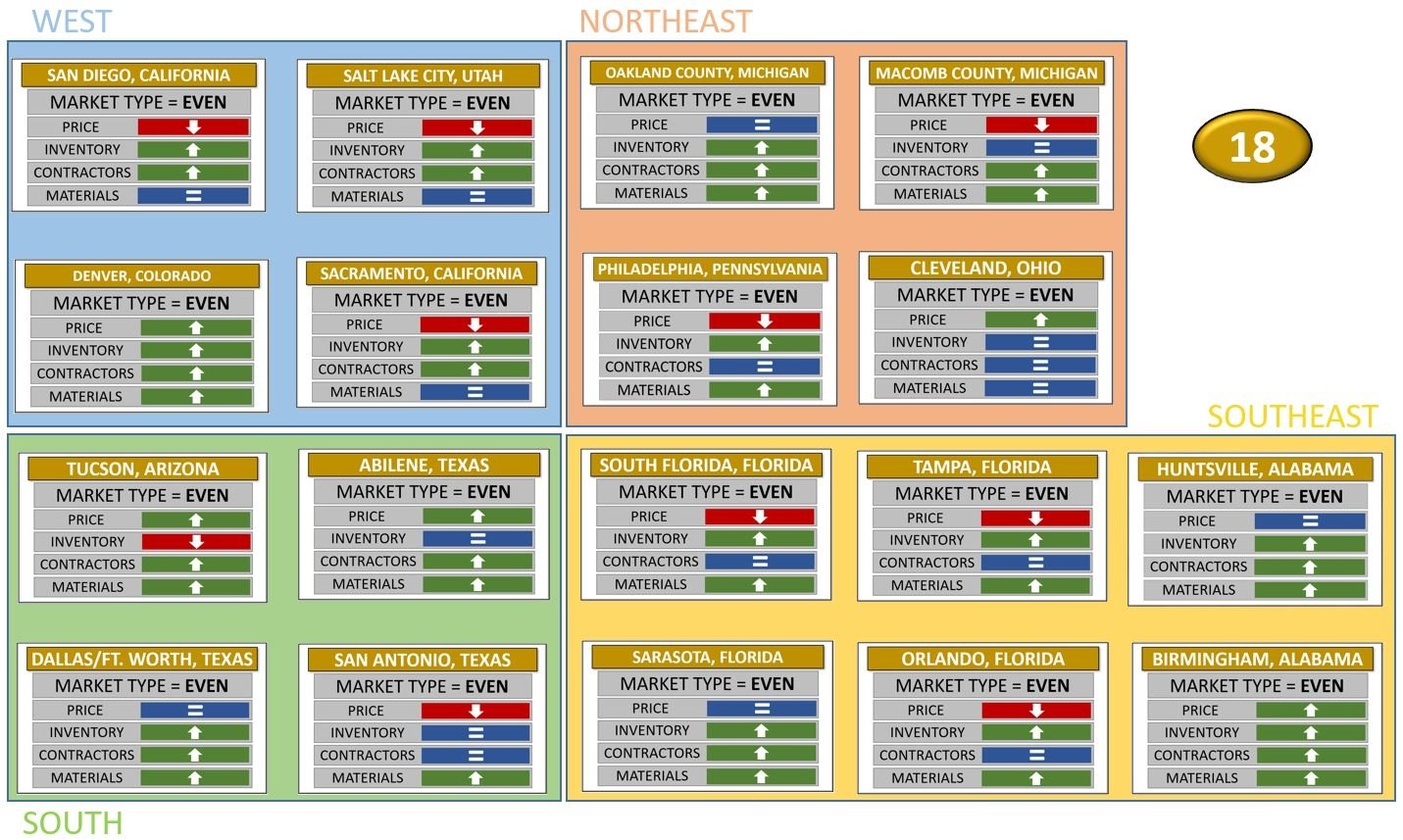

Even Markets Around the Country

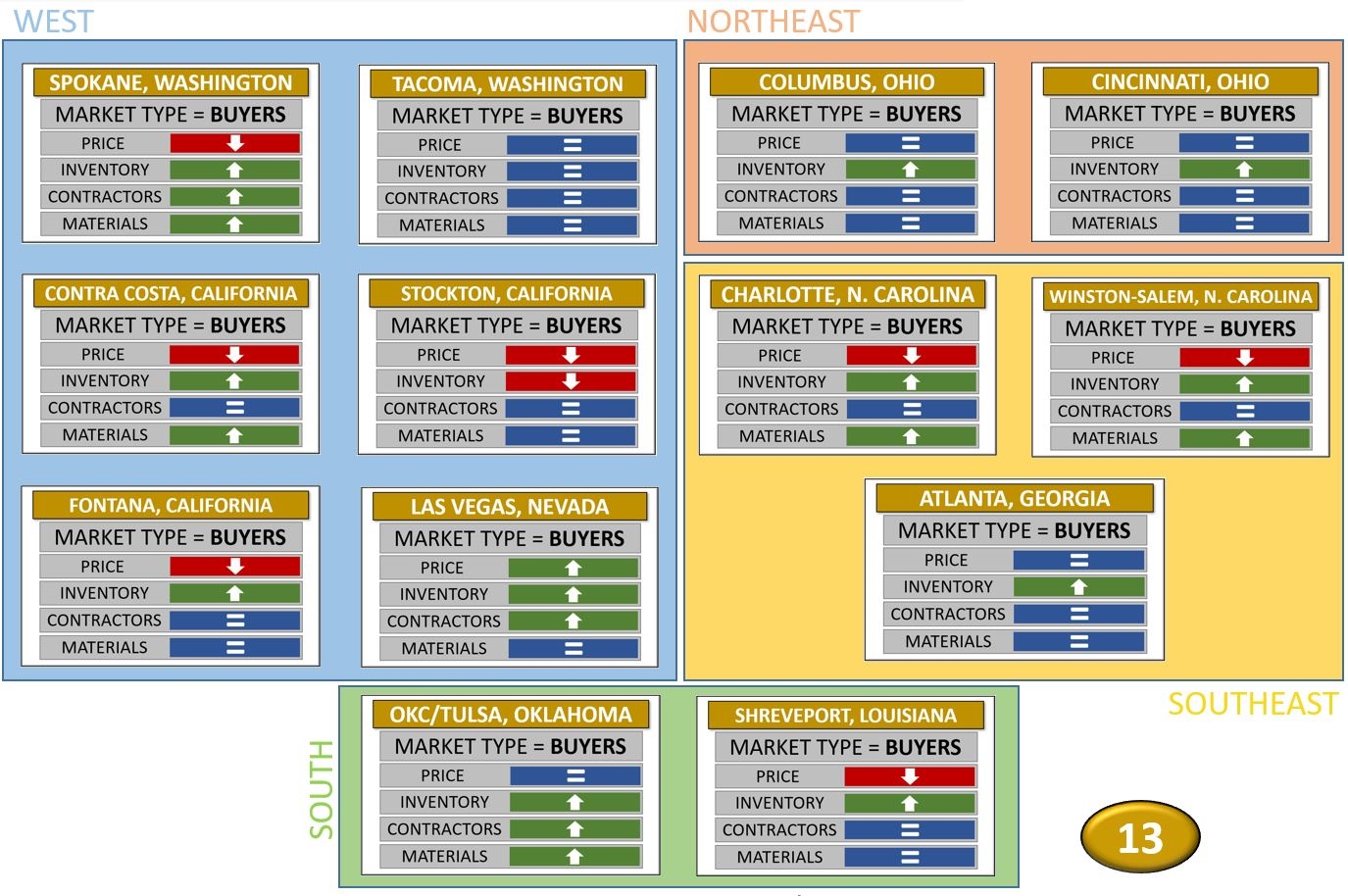

Buyer’s Markets Around the Country

Regional Perspectives

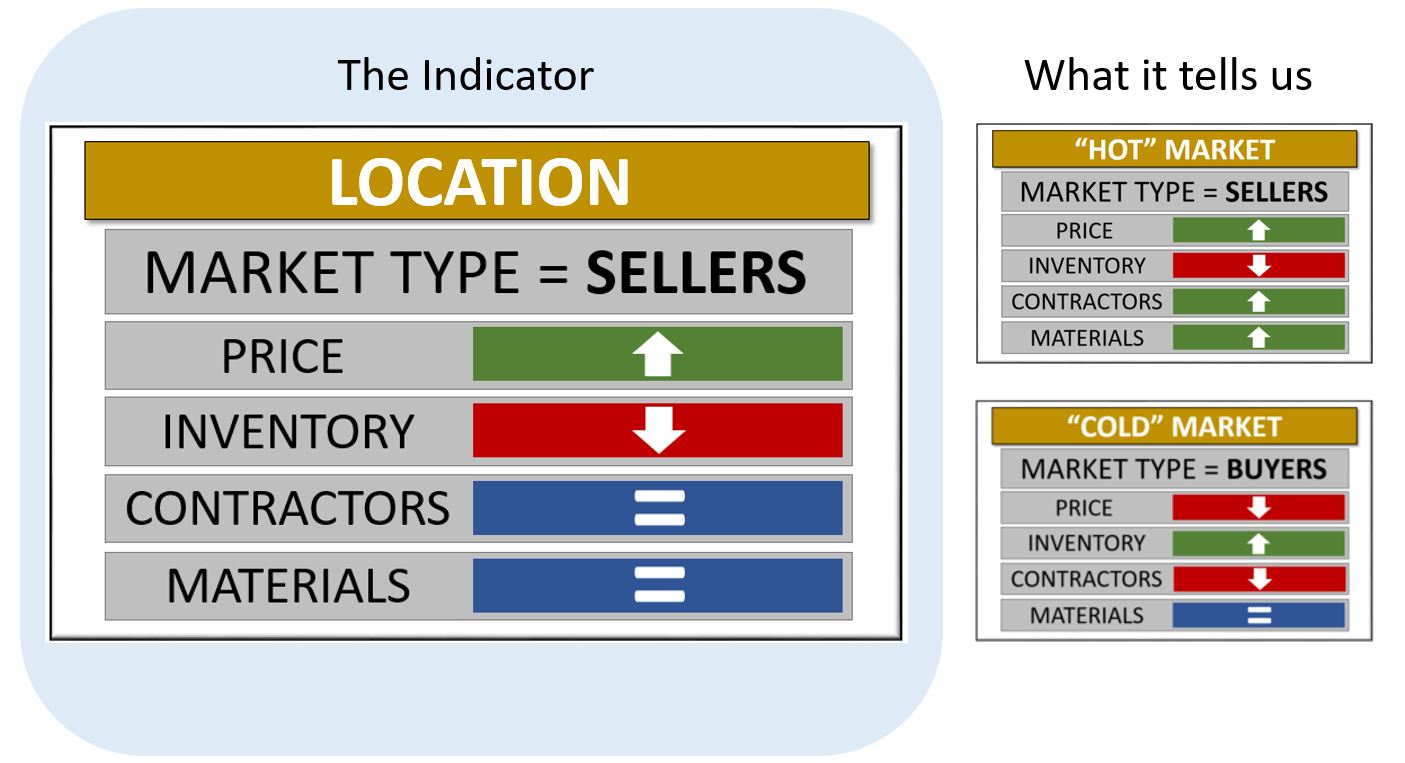

Let’s dig into the regional perspectives, and focus on each region of the United States, and then individual cities within those regions. Before that, I want to explain the graphic that we will be looking at as we look at each of the regions.

About the Graphic

The graphic encapsulates the questions the five questions: what type of market will it be, and what change, if any, is expected to happen in home prices, inventory levels, contractor costs, and materials costs in 2019. A “HOT” market looks the one on the top right: prices are going up, inventory is going down, and the cost to repair homes – the contractors and materials – are going up as well. It’s not necessarily good to be in a hot market; in fact, it can be very difficult to find properties to buy in a hot market. The one advantage of a hot market is when we do find properties, and are able to get the contractors, and the materials and repair those homes and bring them back to excellent condition, those homes sell for top price very, very quickly.

A “COLD” market will look like the graphic on the bottom right: home prices dropping, inventories increasing, the cost of contractors may be going down (because they’re having a difficult time finding work). Material costs could also be decreasing, but we didn’t see a drop in material of labor costs in any market anywhere for our 2019 study. Nobody is expecting a decrease in the cost of materials, but it would more likely occur in a cold market. In this type of market, it’s a buyer’s market, and so it’s easy to buy houses. There’s plenty of inventory, and prices are dropping, but once you buy them, and fix them, you may find it’s difficult to sell them, or they sell for less than you anticipated. Once again it’s not necessarily great to be in a hot, hot market or in a cold, cold market. We really like our markets to be just like the story of the three bears; we like our markets to be warm, kind of in the middle.

Let’s dive into the regions.

The Northeast

The Southeast

The South

The West

Summary

According to the experts that WeBuyHouses.com, we believe the market is shifting from a seller’s market toward an even or a buyer’s market in many areas for this year. While price increases are slowing down, we do believe we will still see price increases in the housing market as a whole in 2019, however not at the rate of increase that we’ve seen in prior years. High-end homes are losing value and entry-level homes are increasing, but at a slower pace. Price changes in 2019 will vary by region from perhaps down 4-5% in California to up 5% or so in the South. We estimate the median home price in the U.S. to increase in 2019 at around 3%. That would take the median home value from $256,000 now to about $263,680 at this time next year. We also believe that inventories will increase next year after 4 straight years of tight housing inventory. We’ll see more homes available in the market next year, an increasing days on market for sellers, and finally we see the cost of labor materials will continue to rise throughout the United States. All of respondents in every region said that rising costs to repair homes is occurring and we believe it will compress profit margins for those investors in the areas where prices are also falling.

We hope that you enjoyed our study, and that you got some great insights for it that will help you, and your planning for the markets in 2019.

For journalists and editors, we want you to know that our report is available for you to incorporate into your stories or articles related to housing market projections for 2019. For more information, or to arrange for an interview with our C.E.O., our V.P. of marketing, or one of our local market experts, contact us at [email protected] or call us at (817) 251-8296.

We wish you a Happy New Year, and we hope that everything goes well for you in 2019. We’ll see you again this time next year.

ABOUT WeBuyHouses.com

Trusted by more than one million homeowners over the past decade, WeBuyHouses.com is one of the most recognized brands in residential real estate investing. For more information about the company, please call 1-877-WeBuyHouses (1-877-932-8946) or visit https://WeBuyHouses.com.