ABSTRACT:

For the We Buy Houses® 2018 Housing Report, we asked 41 of our local real estate experts in 33 markets around the country about their sentiment regarding their local housing market for the coming year. Specifically, we asked 5 questions:

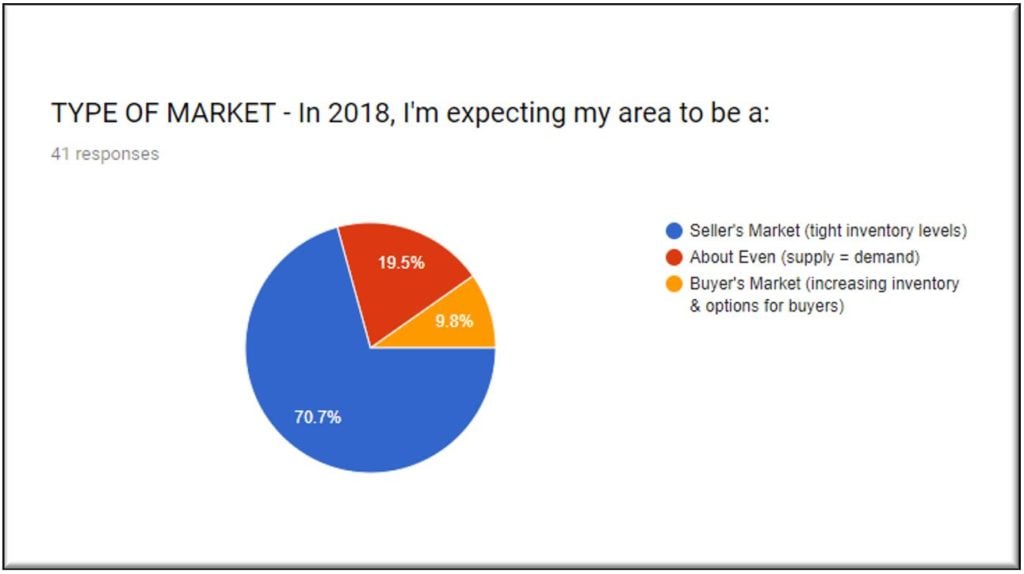

1) In 2018, will it be a SELLER’S or BUYER’S MARKET (or EVEN) in your area?

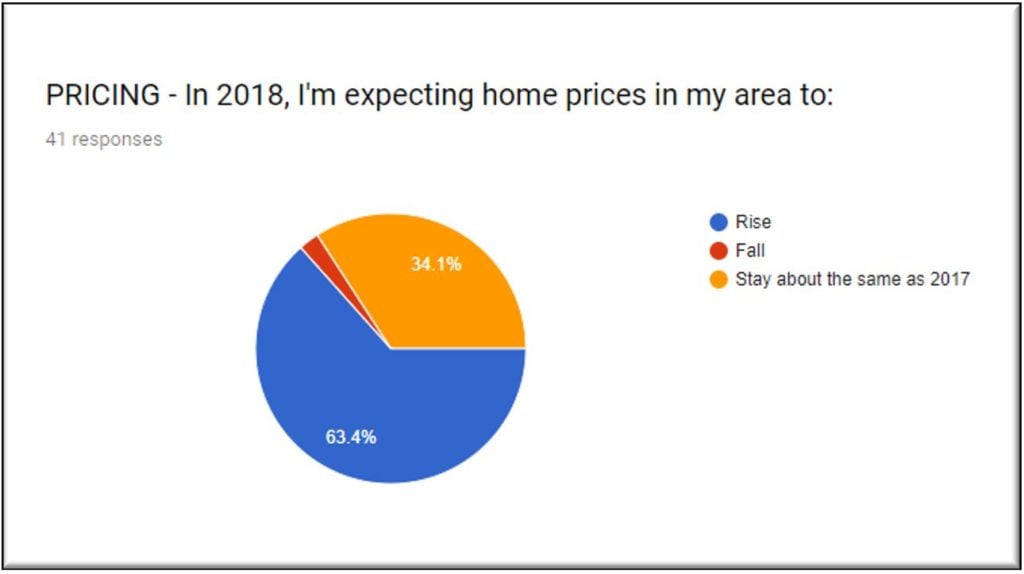

2) HOME PRICES – going up, down or about the same as 2017?

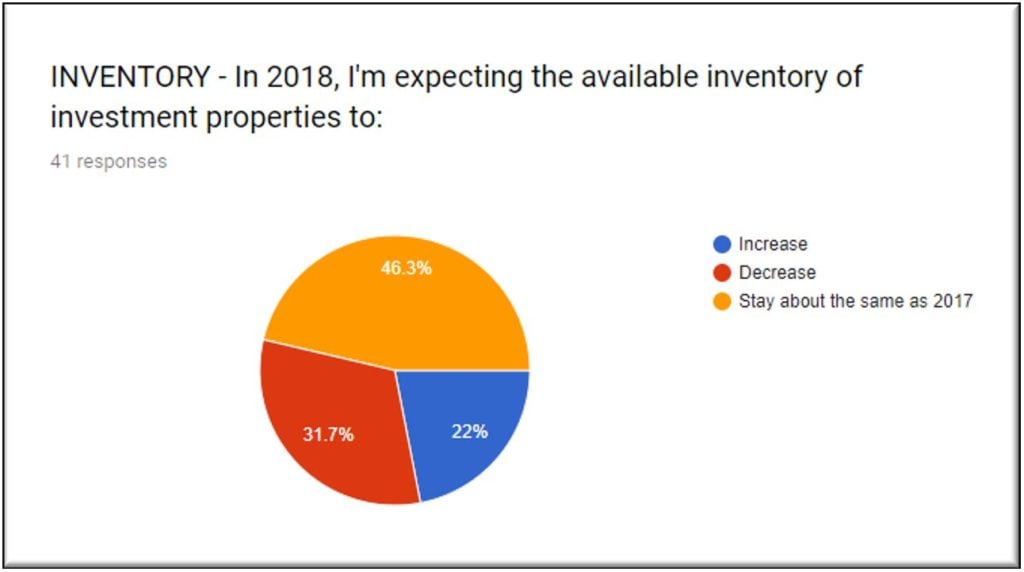

3) INVENTORY OF EXISTING HOMES FOR SALE – going up, down or about the same?

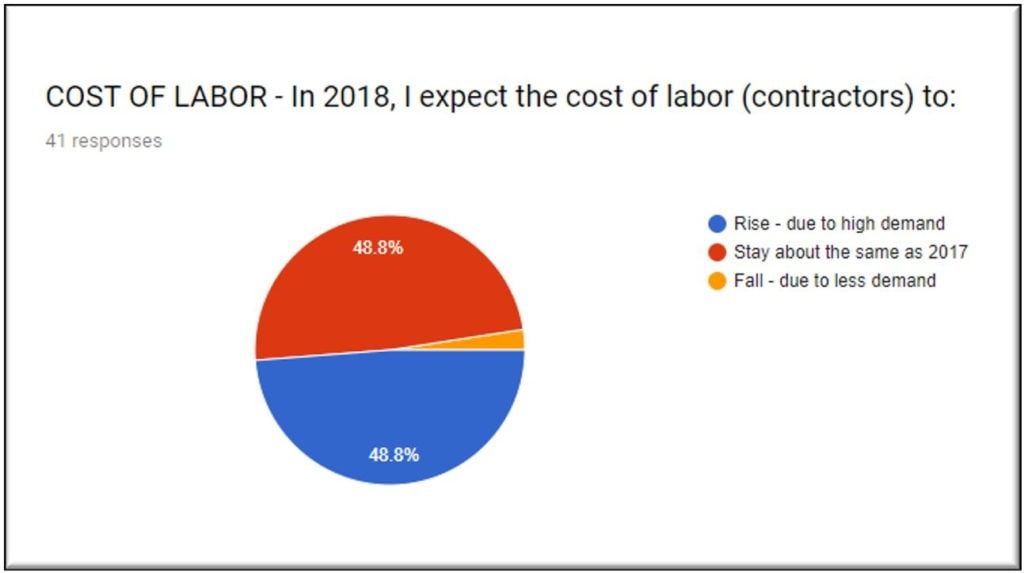

4) CONTRACTOR COST (LABOR) – going up, down or about the same?

5) MATERIAL COST – going up, down or about the same?

NATIONAL Summary:

According to the local market real estate experts at We Buy Houses®, 2018 will continue to be a “Seller’s Market” in over 70% of suburban markets in the U.S., with slightly less than 10% predicting that it will a “Buyer’s Market” next year.

Home prices are expected to rise again in over 60% of U.S. markets, and expected to stay about the same in over 34%. Our experts expect there to be lower inventory in over 31% of local markets, with inventory increasing in only about 22% of markets next year.

Regarding the costs for renovation, We Buy Houses® local market representatives expect the cost of contractors (labor) to rise in 48% of markets and stay about the same in another 48% of our areas, leaving only a few percent of our markets in which cost of labor is expected to decrease. The cost of materials is expected to rise again in 49% of U.S. markets and stay about the same as last year in the other 51%. There were no respondents that expect material costs to decrease next year.

Conclusion: It’s a Seller’s Market again for most local markets in 2018. We Buy Houses® expects home prices to rise 4% to 8% in major suburban markets in 2018, with a median increase of 5.5% We expect the median price of homes to rise from $248,000 in December 2017 to $262,000 by the end of this year.

REGIONAL Summaries:

The Northeast

We Buy Houses® local market experts in the northeastern U.S. expect a Seller’s Market again with along with rising prices, with all other factors (housing inventory, cost of labor, cost of materials) being about the same as 2017. The “HOTTEST” We Buy Houses® market in the Northeast in 2018 is expected to be Washington, D.C.

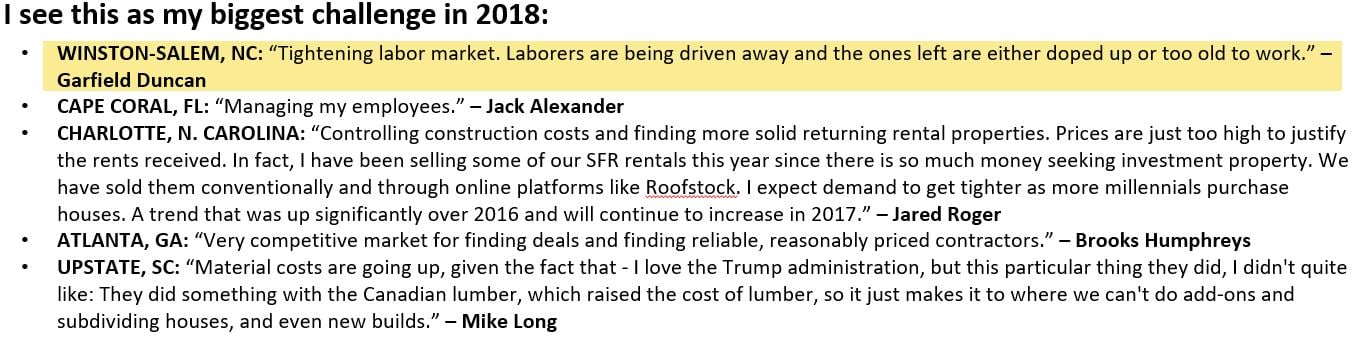

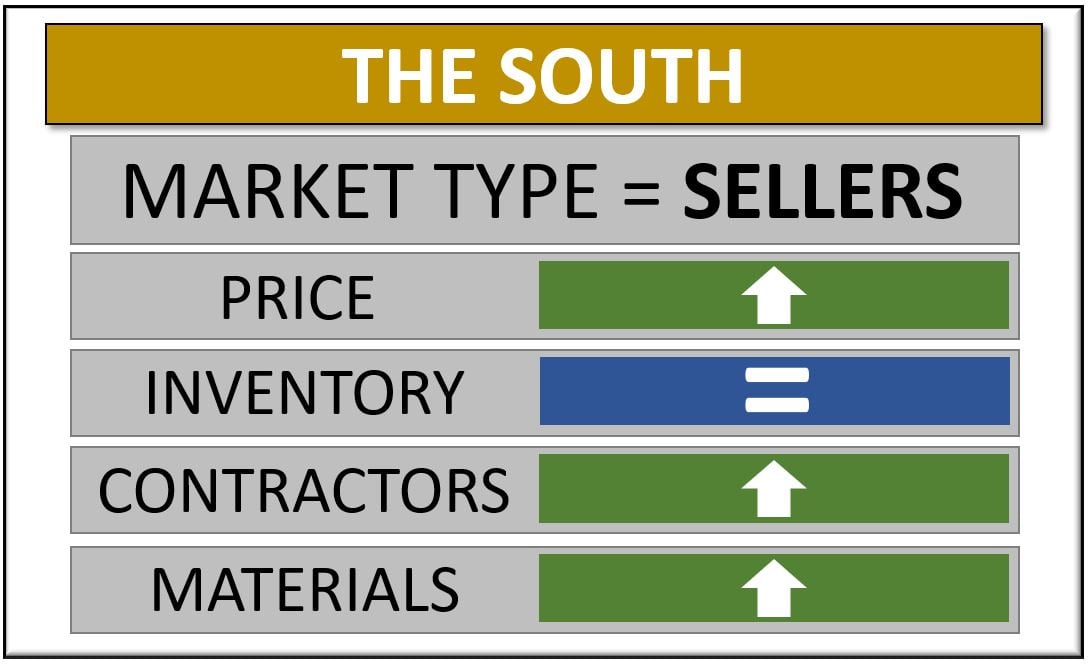

The Southeast

In the southeastern markets, we expect a Seller’s Market with rising home prices and increasing cost of materials. Inventory will remain tight and cost of labor will be about the same as 2017. The Florida area was hit by hurricane Irma in 2017, which has contributed to an increase in material costs at the onset of 2018. The “HOTTEST” We Buy Houses® market in the Southeast in 2018 is expected to be Charlotte, N.C.

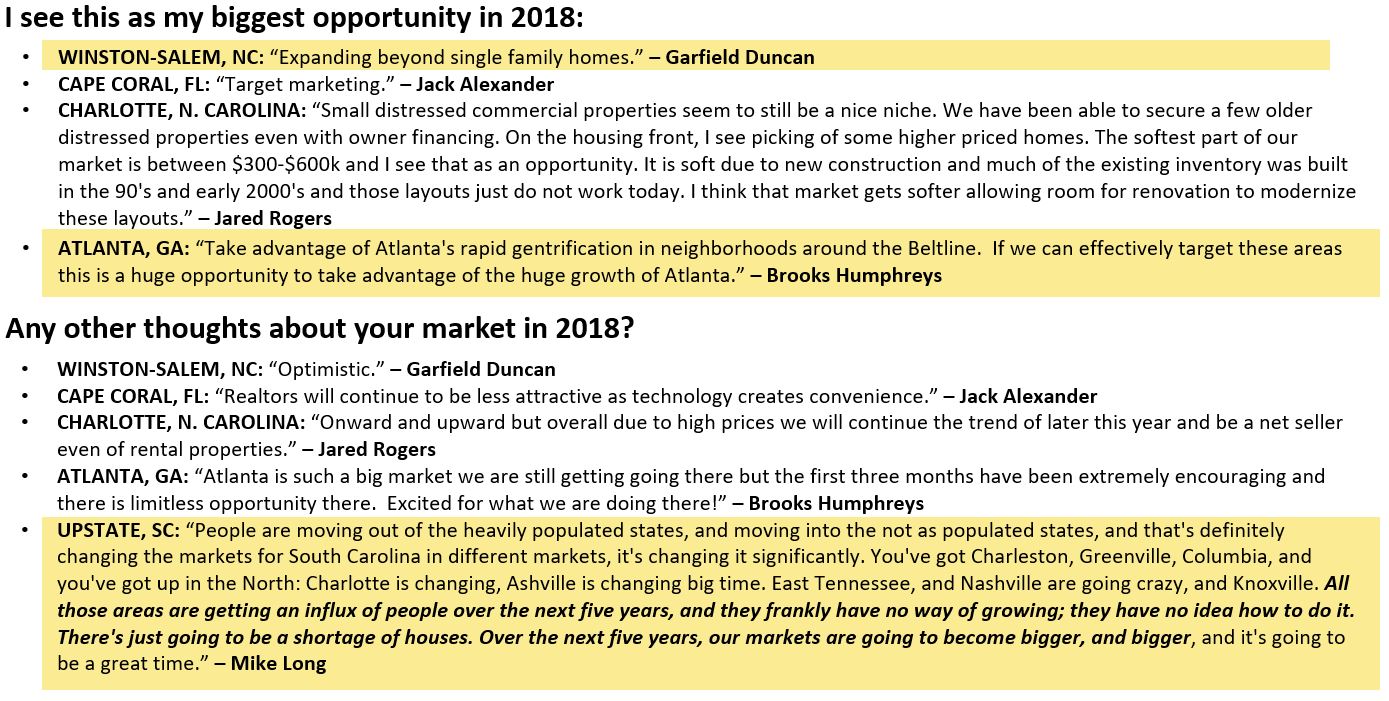

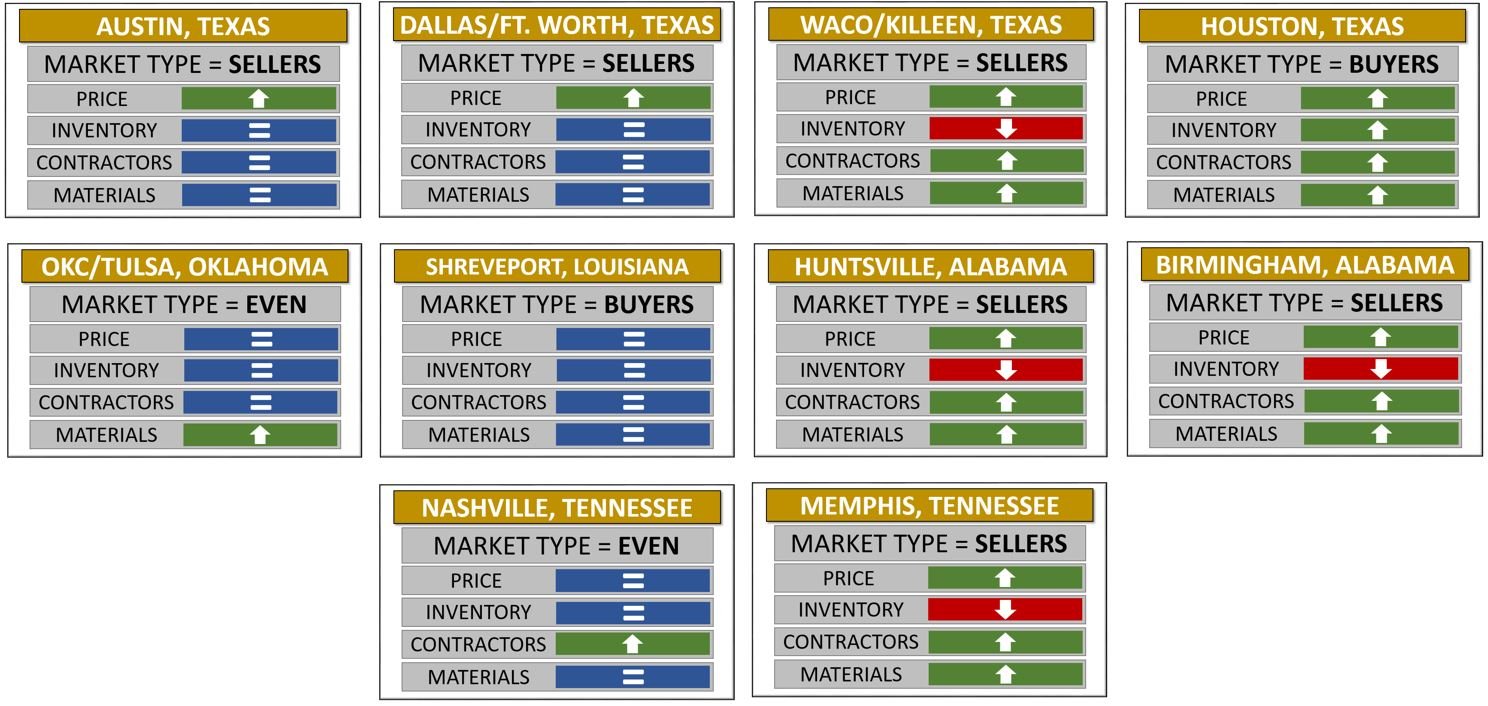

The South

The southern region of the U.S. is likely the “hottest” of the four regions identified by We Buy Houses® and it will be a Seller’s Market in 2018. Our local market experts are expecting home prices to rise along with the cost of labor and materials, in part due to the residual effects of Hurricane Harvey in 2017. Inventory is expected to remain about the same as 2017, a year in which housing inventory in the South was very tight. The “HOTTEST” We Buy Houses® market in the South in 2018 is expected to be Memphis, TN. (However, Waco, TX emerged as one of the most attractive and productive markets in the We Buy Houses® system in 2017, perhaps due to the popularity the area has received from the HGTV show “Fixer Upper”).

The West

The western U.S. is the most competitive region for our professional real estate investors and it will definitely be a Seller’s Market again in 2018. Prices in prime suburban markets in the west – such as San Diego, CA and Colorado Springs, CO – will continue to rise in 2018 as inventories remain very constrained. We expect the cost of labor and materials to be about the same as in 2017. The “HOTTEST” We Buy Houses® market in the West in 2018 is expected to be Seattle, WA.

WATCH: We Buy Houses® 2018 Housing Market Report on YouTube

PRESS: Materials available include local market infographics and local expert commentary for all 33 markets and the 4 regions. Our CEO and local market experts are available for interviews, and high-resolution headshots are available as well.

FOR MORE INFORMATION: Contact We Buy Houses® at [email protected] or (817) 251-8296

![]()

THE WE BUY HOUSES® 2018 HOUSING MARKET REPORT (EXPANDED)

We asked these 5 questions of 41 local market experts in 33 local markets across the U.S.:

- What type of market will it be in your area next year?

- a seller’s market

- a buyer’s market

- or about even

- Do you expect home prices to…?

- Rise

- Fall

- Or be about the same as in 2017

- Are you expecting the available inventory of investment properties to…?

- Increase

- Decrease

- Or be about the same as 2017

- Do you expect the cost of labor & contractors in your market to…?

- Rise due to high demand

- Fall due to less demand

- Or stay about the same as in 2017

- Do you expect material costs to…?

- Rise due to high demand

- Fall due to less demand

- Or stay about the same as 2017

In this report we’ll look at our experts answers to these five questions on three levels: national, regional, and local. Let’s start at the national overview level, and review what the 41 We Buy Houses® local market experts in 33 markets told us.

National > Overview

Type of Market

They said that next year in 70.7% of their markets, it will be a seller’s market, and only in about 9.8% will it be a buyer’s market. The other 19.5% they’re saying about even. This is our third year of doing the report, and this is consistent with what we’ve seen in the past; the housing market continues to be a seller’s market due to tight inventory levels. Demand for single-family homes will continue to exceed the supply in 2018.

Home Prices

Regarding pricing on a national level, We Buy Houses® business owners across the United States expect prices to rise in 63.4% of their markets, and to stay about the same as in 2017 in 34.1% of their markets. That leaves just 2.5% where they believe homes prices may fall.

Inventory

Regarding inventory in 2018, the We Buy Houses® local market experts are expecting inventory to increase in only 22% of markets, whereas in 46% they expect it to be about the same as 2017 – which you remember was very tight – and actually decrease in 31% of their markets. We continue to see inventory of single-family homes being very tight, very constrained in 2018, similar to what we’ve seen the past two years.

Cost of Labor

Regarding the cost of labor, the local market experts at We Buy Houses® say that they expect labor costs to rise in 48.8% of the markets, and stay about the same in 48.8%. That just leaves 2.4% where the cost of labor may fall. We are expecting the availability of contractors to be tight in 2018, and therefore we’re expecting rising costs in many of our markets.

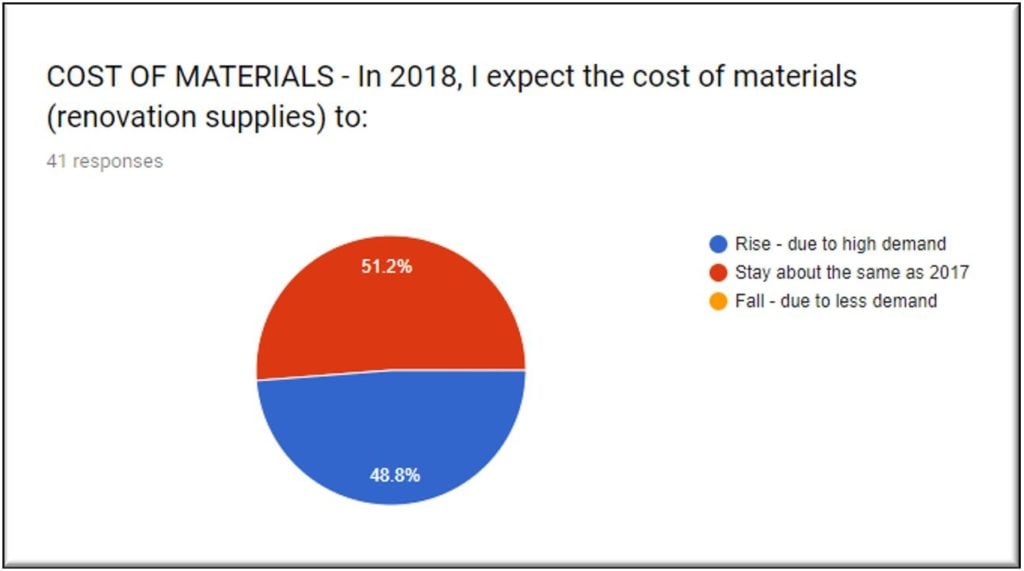

Cost of Materials

Regarding the cost of materials in 2018, our local market experts continue to see material costs rise and 48.8% of the markets, and they say it will stay about the same in 51.2%, which again we saw rising prices in 2017, so overall, we believe that the cost of materials will be increasing in 2018 for most of our professional real estate investors.

Regional Perspectives

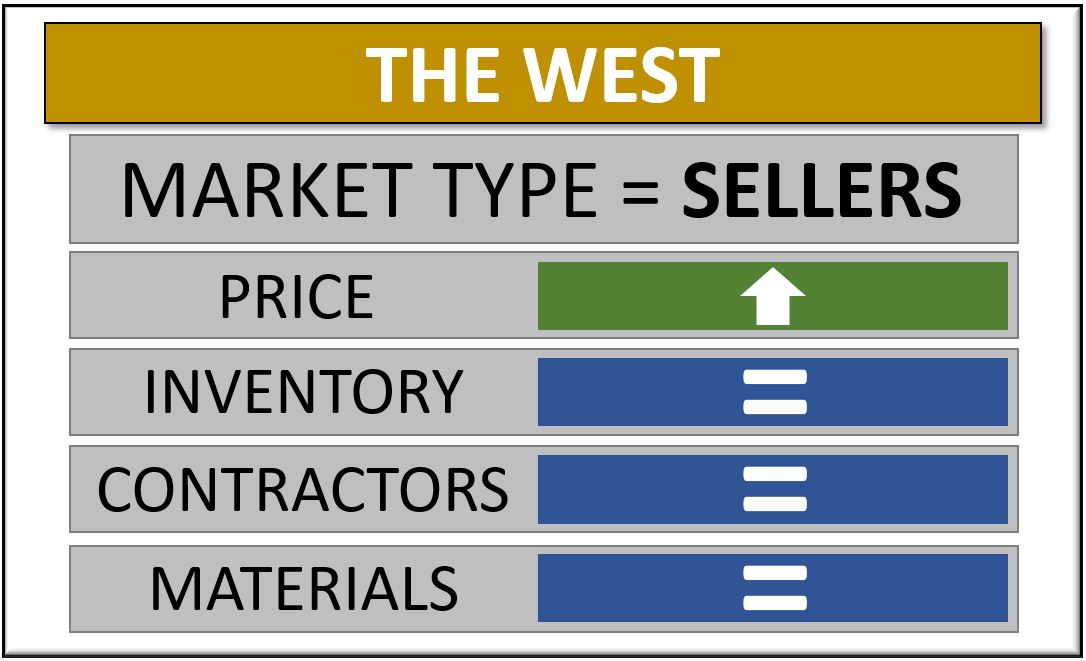

Let’s dig into the regional perspectives, and focus on each region of the United States, and then individual cities within those regions. Before that, I want to explain the graphic that we will be looking at as we look at each of the regions.

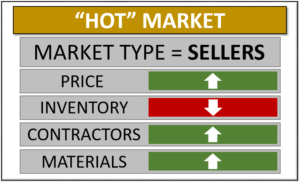

About the Graphic

The graphic encapsulates the questions the five questions: what type of market will it be, and what change, if any, is expected to happen in home prices, inventory levels, contractor costs, and materials costs in 2018. A “HOT” market looks the one on the left (or top, if you’re on a phone): prices are going up, inventory is going down, and the cost to repair homes – the contractors and materials – are going up as well. It’s not necessarily good to be in a hot market; in fact, it can be very difficult to find properties to buy in a hot market. The one advantage of a hot market is when we do find properties, and are able to get the contractors, and the materials and repair those homes and bring them back to excellent condition, those homes sell for top price very, very quickly.

A “COLD” market will look like the graphic on the right (or bottom): home prices dropping, inventories increasing, the cost of contractors is going down (because they’re having a difficult time finding work). Material costs could also be decreasing, but we didn’t see this in any market anywhere for our 2018 study. Nobody is expecting a decrease in the cost of materials, but it would more likely occur in a cold market. In this type of market, it’s a buyer’s market, and so it’s easy to buy houses. There’s plenty of inventory, and prices are dropping, but once you buy them, and fix them, you may find it’s difficult to sell them, or they sell for less than you anticipated. Once again it’s not necessarily great to be in a hot, hot market or in a cold, cold market. We really like our markets to be just like the story of the three bears; we like our markets to be warm, kind of in the middle.

Let’s dive into the regions.

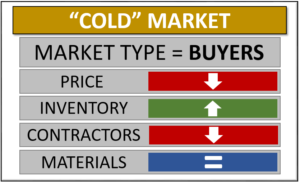

The Northeast

The first region we’re going to look at is the Northeast. When we look at the Northeast, the regional graphic (above) tells us in the Northeast, prices will be going up, and inventory, contractors, and materials will be about the same as they were in 2017, which means again continued constraints on inventory in that market area.

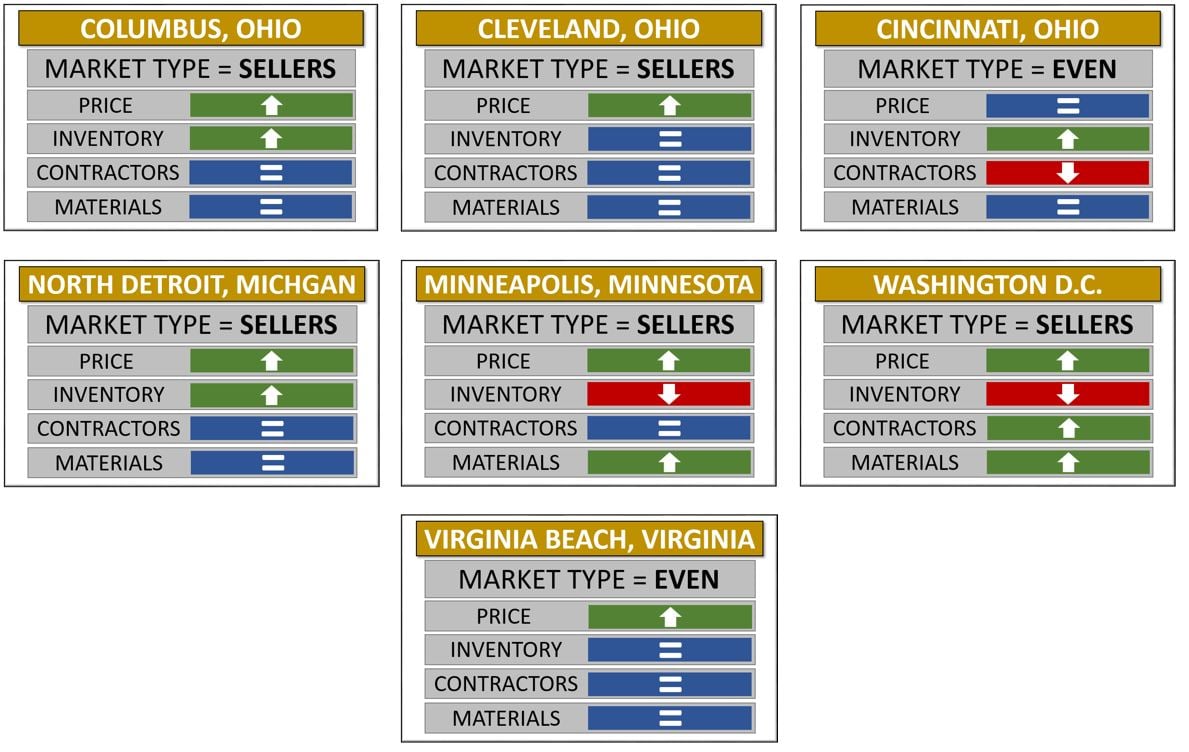

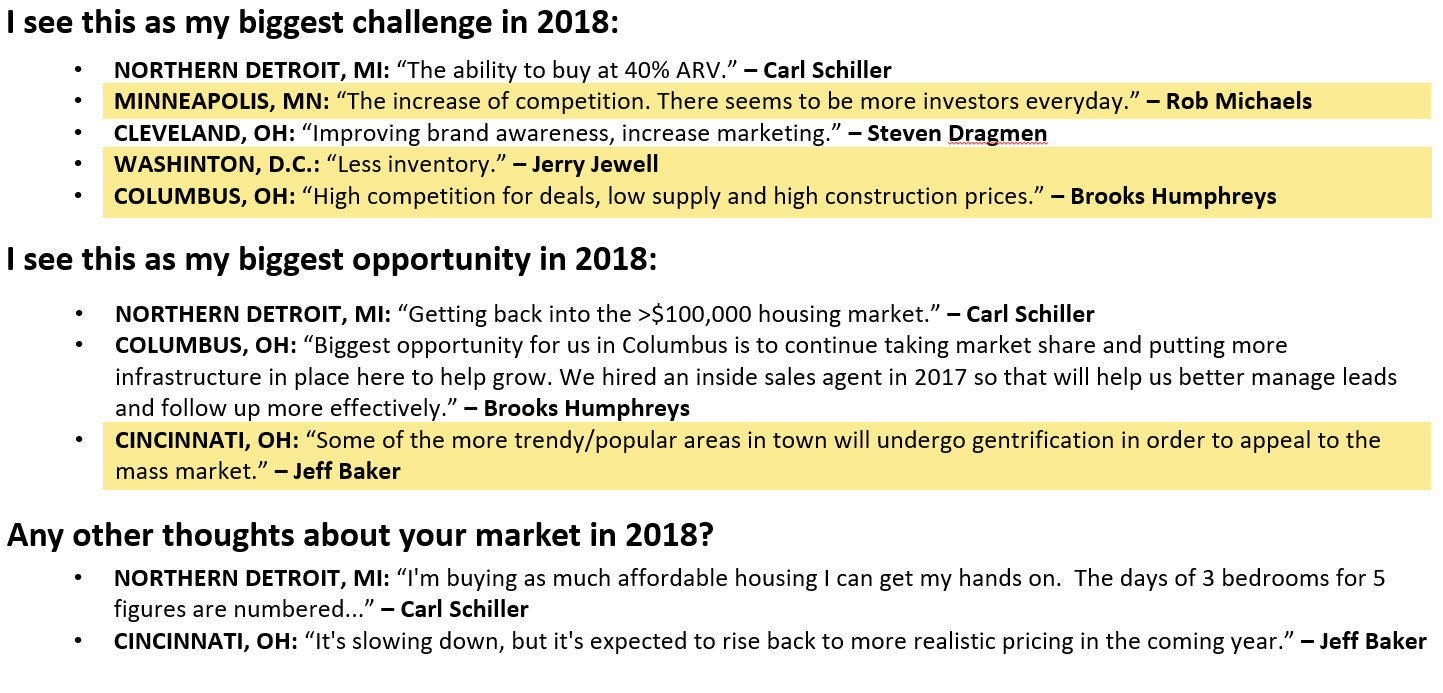

If we dig into the cities of the Northeast, we have these seven represented in the study: Columbus, Ohio; Cleveland, Ohio; Cincinnati, Ohio; North Detroit, Michigan; Minneapolis, Minnesota; Washington, D.C.; and Virginia Beach, Virginia.

While Columbus has home prices going up, they also see an increase in inventory & it’s the same thing in the northern Detroit area of Michigan. Washington D.C. is a typical hot market, like you saw in our example graphic: price going up inventory going down and the cost of contractors and materials are on the rise. As you look around you can see that Ohio is kind of a little bit of a mixed bag. The Cleveland market is colder than the Columbus market, and Cincinnati market is, perhaps, the coldest of them all of the Ohio markets. Each of these give you a different view, and we see that when you look at it at a regional level, we definitely see home prices rising, and inventory about the same as last year, but when you dig in to the local markets, sometimes you see something quite different.

As we looked at the comments made by the We Buy Houses® local market experts in the Northeast, they definitely represent something that we’re seeing across the country. Rob Michaels in Minneapolis, Minnesota says “the increase of competition” is going to be a challenge in 2018, as “there seems to be more investors every day.” Jerry Jewell in Washington, D.C. talks about there being “less inventory,” and Brooks Humphreys in Columbus talks about “high competition for deals, low supply, and high construction prices.” That’s exactly what we’re talking about; that confluence of conditions of high demand, low supply, and high cost to repair. Now as far as opportunities, Jeff Baker in Cincinnati mentioned “some of the more trendy, popular areas in town will undergo gentrification in order to appeal to the mass market,” and we’re definitely seeing this in Cleveland, Cincinnati, and a lot of markets where we’re seeing gentrification. It really points us in the right direction as far as the neighborhoods that we want to go to next. You know what areas are becoming more trendy and cool, where are the people going, and buying, and really starting to renovate neighborhoods, and that’s exactly what we’re seeing in many of the neighborhoods in the Northeast.

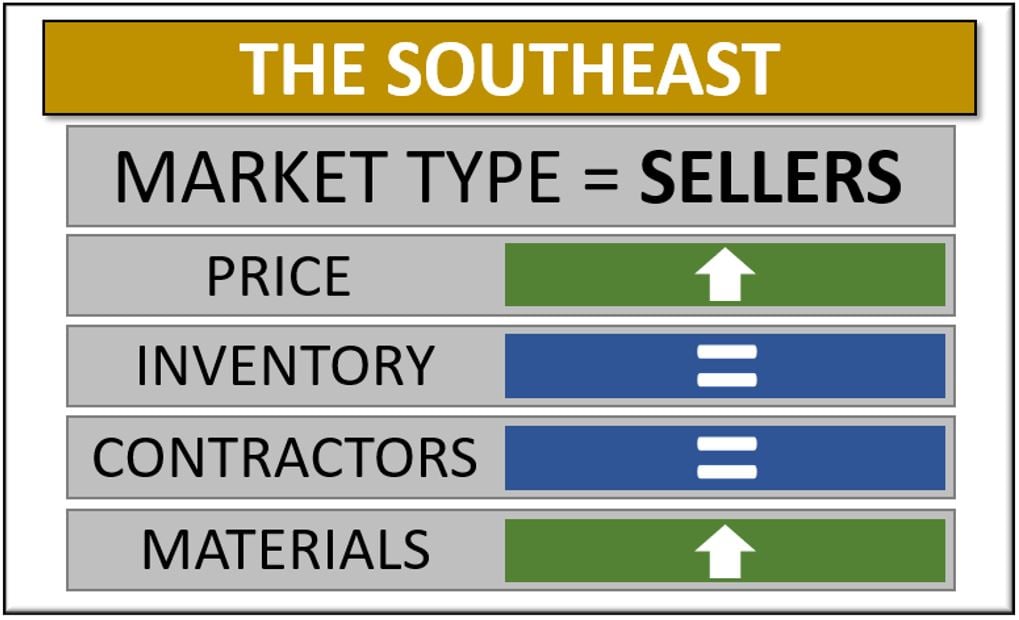

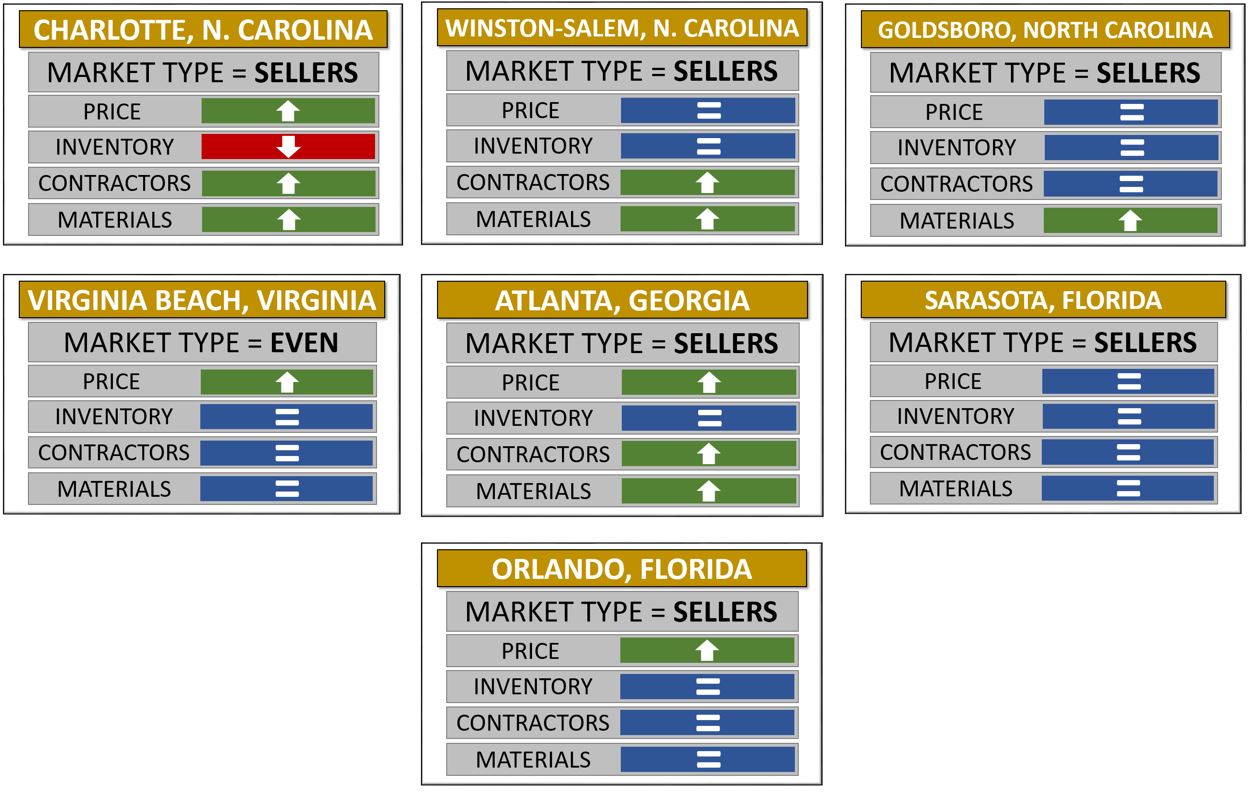

The Southeast

In the Southeast, we’re expecting home prices to rise, and inventory and the cost of contractors to be about the same as last year, but we are expecting material costs to increase. The southeast is one of the regions that was struck by a major hurricane in 2017, and we see it was a contributing factor to the rising cost of materials in many markets.

If we look at cities within the Southeast we noticed that Charlotte, North Carolina is that typical hot market profile: increasing home prices, decreasing inventory, and the cost of contractors and materials is rising. If you go down to, say, a smaller market like a Sarasota, Florida, they’re basically expecting 2018 to be just like 2017, which was a tight inventory market, and prices have come up but they’re not necessarily looking for price increases next year. That’s also true in Winston-Salem, North Carolina. You can see that the conditions vary a little bit as you go across the markets, but in most cases, we’re expecting an increase in home prices, and inventory to be about the same as last year in the Southeast.

When we look at quotes from the Southeast from our experts, in Winston-Salem, North Carolina, we see a “tightening labor market,” according to Garfield Duncan, and other issues such as “laborers being driven away, and the ones left are either doped-up or too old to work.” We wondered about including this comment in the study, but it really has become a problem for us in some of our markets especially in West Virginia, North Carolina, and some of the other states on the East Coast, where things like the opioid epidemic have definitely impacted our availability of quality contractors. It’s unfortunate, but it’s true, and we’ve seen the impact of it in our study and in our results in 2017. Garfield sees that his biggest opportunity is to “[expand] beyond single-family homes,” in that very hot Winston-Salem, North Carolina market. Some other comments that we had in the Southeast: in Atlanta, Georgia Brooks Humphrey said their greatest opportunity in 2018 is to “take advantage of Atlanta’s rapid gentrification in neighborhoods around the Beltline.” He says “if we effectively target these areas this is a huge opportunity to take advantage of the huge growth of Atlanta.” Again, we’re seeing this if you look down at the next highlighted statement; Mike long in South Carolina also just talks about people moving to South Carolina from other, more populated states. He says “all of these areas are getting in influx of people over in the next five years, and they frankly have no way of growing; they have no idea how to do it. There’s just going to be a shortage of houses. Over the next five years our markets are going to become bigger, and bigger, and it’s going to be a great time.” We’re basically seeing that these effects of gentrification of the larger suburban markets, and we’re also seeing a continued trend of people moving from heavily populated, dense markets into some of the less populated, less dense areas of the south and southeast.

The South

The South is definitely a hot area as we go into 2018, just as it was in 2017; with rising home prices, inventory about the same as last year, which means continued constraints on inventory, and contractors and materials costs are going up in the South – again the South being one area that was had a major impact in 2017 as a result of Hurricane Harvey.

You’ll see that whole top band is Texas – from Austin all the way over to Houston – and it’s an interesting view: in Austin and Dallas Fort Worth, home prices are expected to increase, but everything else is expected stay about the same as 2017. Waco/Killeen is a market that’s probably one of the hottest markets in the United States today. It could be a result of the popular show on HGTV that’s based in Waco, but for whatever reason, people like Waco, and they’re moving there, so it has that hot market profile: rising home prices, decreasing inventory, everything else going up. As for Houston, everything is up, up, up. We will bring up a quote from the local market expert in Houston explaining these conditions in the next section. As we look across some of the other markets, areas like Oklahoma and Louisiana are either even, or shifting towards being buyer’s markets, where areas like Huntsville and Birmingham, Alabama have that hot market profile like we see in some of the other markets. Finally, at the bottom, we see Nashville and Memphis is really a tale of two cities in one state. The Nashville housing market seems to be cooling off, while the Memphis housing market is staying super, super hot.

As far as quotes to highlight from the south, Brad Reedy in Memphis, Tennessee said they expect their biggest challenge to be “less inventory and tighter margins,” and Clinton Newton in Huntsville, Alabama also mentioned the same, “tight inventory, more challenging to get deals at the right price to make the margin needed.” Notice what some of these guys said is the biggest opportunity in 2018: it’s to expand their use of the We Buy Houses® brand power, because in a super competitive market brand it’s more important than ever, and the way that the professionals can best stand out above all the newbies and the pretenders in the marketplace is to exploit their national We Buy Houses® brand in their local market. We definitely saw a lot of that in 2017, and we expect to see that brand push increase in 2018 in all these markets. I talked about the quote that our guy in Houston, Chris Uhler, had made regarding the post-Harvey market that they have down there: his quote is “We’re in a different ball of wax here after Harvey. That’s why I say it’ll turn into a buyer’s market. It’s tough because there’s really two markets now: the flooded market, and the non-flooded market. I think it’s going to be a buyer’s market for flooded houses for sure, because there’s going to be a lot more inventory than most investors are able to digest.” It really is a tale of two markets there: the flooded market and the non-flooded market; the flooded market being a buyer’s market, and a non-flooded market a seller’s market, in essence.

The West

Finally, let’s wrap up by looking at the West. In the West, we expect prices to rise, and inventory, contractors, and materials to be about the same as last year.

Finally, let’s wrap up by looking at the West. In the West, we expect prices to rise, and inventory, contractors, and materials to be about the same as last year.

Looking across our local markets in the West, you see Seattle is one of the hottest markets in the country – it’s got that hot, hot market profile of rising prices, decreasing inventory, everything else going up. Go all the way down to the bottom, and you’ll see that St. George, Utah, which is a secondary/smaller market, has really shifted and, really, never was a substantial seller’s market, and they were likely a buyer’s market in 2017 as well. Depending upon the size of the market and the location of the market in the West, some of them are super, super hot, such as the Contra Costa market, and San Diego. Both markets have prices are either staying the same, because they’ve already been super high, or just continuing to increase. We’re hoping for cooling down of those California markets, as it’s very difficult to buy homes in California right now. Colorado Springs is another hot area where we see prices increasing inventory about the same as 2017 (but keep in mind that that means constrained), and we see the price of contractors and materials rise as markets like Colorado Springs continue to be very appealing to home buyers in 2018.

As far as the comments that we got from our local experts in the West, we wanted to highlight were from Tim Powers, who is in Contra Costa County/Walnut Creek, California area, and he said his challenges were “finding properties to buy due to low inventory, and competing with many, many investors” who are attracted to the California market, because it’s lucrative if you can find and flip a house – it’s just super hard to find them. Notice what Tim said under the biggest opportunity; he said “people will start to think that we are at the top, or near the top and will decide to sell.” That’s what we’ve seen in super-hot markets like in the West – in California – often, homeowners will delay selling a home, because they perceive that if they can just wait a few more months the price could go up another 10-30 thousand dollars, and that’s a great incentive for holding on for a little bit longer. Once they perceive that we’re near the top, or that prices are starting to decrease that mentality will shift, and they’ll be more likely to consider selling their home. Finally we wanted to highlight that Seattle market. J.J. Clark, our expert there, says “Seattle is absolutely crazy right now. Fastest growing large city in the nation, and leading to inflated prices, see: $400,000 for condemned tear downs. Really hoping for the market to correct itself.” We definitely saw that Seattle, Washington market having the profile of a very hot market for 2018.

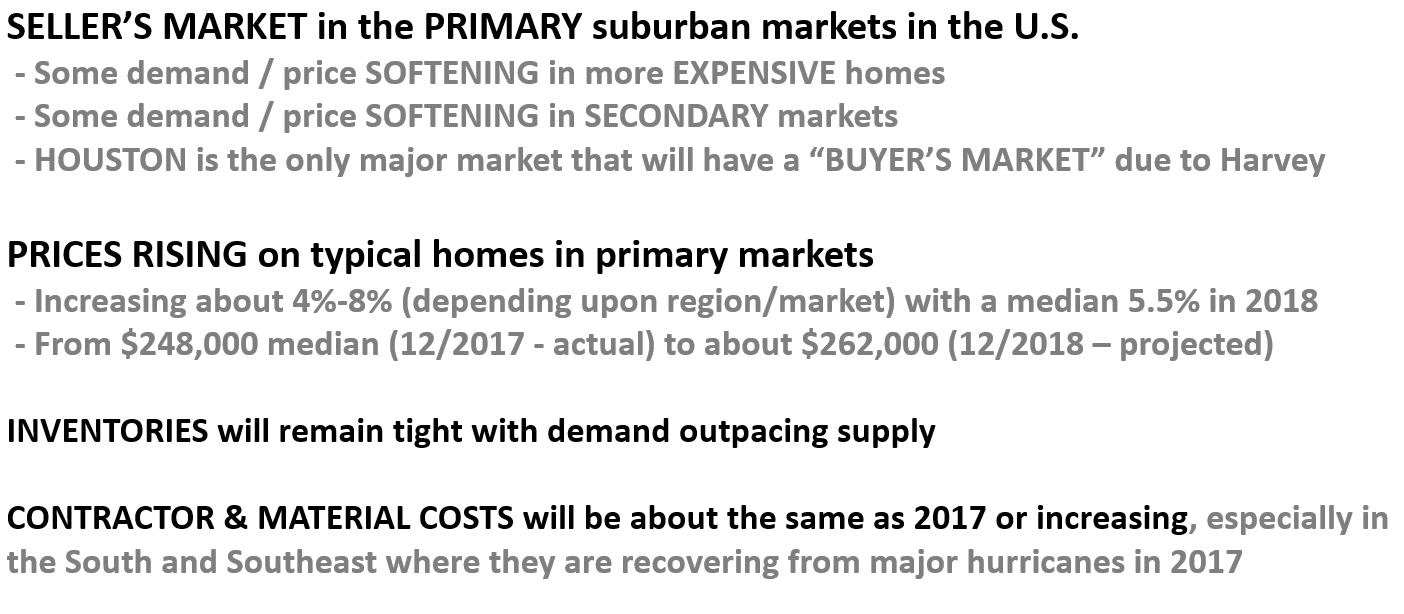

Summary

In summary, as we step back and look at the four regions that we divided the country into, the Northeast and Southeast have very similar with home prices rising, inventory staying about the same, material costs rising in the Southeast and the South – where they’re dealing with those post hurricane situations. This tells a story if you step back, and look at of inventory (about the same as 2017), and prices rising, and that makes it a seller’s market across the country in 2018 according to our 40 local market experts in 33 markets across the United States. We see that it’s a seller’s market, in the primary suburban markets in the United States in 2018. There will be some demand and price softening among more expensive homes in most markets, and some softening and price and demand in secondary markets. Houston’s the only major market where we see a buyer’s market condition, but that’s really regarding the flooded market that was due to the Hurricane Harvey situation that occurred in 2017. Prices will be rising on typical homes in primary markets; We expect price increases in 2018 of 4% to 8% across most primary markets. As we wrap up 2017, the average home the median value is $248K, and we expect that to rise to $262K by the end of December 2018. Inventories will remain tight, with demand outpacing supply. Contractor and material costs will be about the same as 2017, or increasing, especially in the South and Southeast where they are recovering from major hurricanes.

We hope that you enjoyed our study, and that you got some great insights for it that will help you, and your planning for the markets in 2018.

For journalists and editors, we want you to know that our report is available for you to incorporate into your stories or articles related to housing market projections for 2018. For more information, or to arrange for an interview with our C.E.O., our V.P. of marketing, or one of our local market experts, contact us at [email protected] or call us at (817) 251-8296.

We wish you a Happy New Year, and we hope that everything goes well for you in 2018. We’ll see you again this time next year.

ABOUT We Buy Houses®

Trusted by more than one million homeowners over the past decade, We Buy Houses® is one of the most recognized brands in residential real estate investing. For more information about the company, please call 1-877-WeBuyHouses (1-877-932-8946) or visit https://WeBuyHouses.com.